Bulls and bears were evenly matched during last week’s trading, with bears wresting a slight advantage. FIIs were net buyers of equity worth Rs 1130 Crores as per provisional figures. DIIs were net sellers of equity worth Rs 1135 Crores.

Commerce and Industry Minister Nirmala Sitharaman, in a written reply to the Lok Sabha, mentioned: "After the launch of 'Make in India' initiative in September 2014, there has been a 48% increase in FDI equity inflows during Oct 2014 to Apr 2015 over the corresponding period last year."

A quick resolution of the contentious retrospective MAT on foreign investors, and reform of draconian labour laws will pave the way for much more FDI inflows.

BSE Sensex index chart

A steep up trend line and negative divergences visible on all four daily technical indicators in last week’s post on the daily bar chart pattern of Sensex had led to the following comments: “Expect a correction towards the blue up trend line. Note that the up trend itself may be under a cloud.”

The index bounced up after successfully testing support from the blue up trend line mid-week, but slid down and closed just below the up trend line by the end of the week.

Note that the breach of the up trend line hasn’t been a convincing one yet, and the index received good support from its rising 20 day EMA. The bulls may have lost last week’s battle, but haven’t lost the war.

Daily technical indicators are in bullish zones, but looking bearish. MACD has slipped down to touch its signal line in positive zone. ROC has dropped to touch its 10 day MA in positive zone. RSI is seeking support from its 50% level. Slow stochastic has fallen down from its overbought zone.

Some more correction/consolidation is likely. Stay invested, or gradually accumulate fundamentally strong stocks.

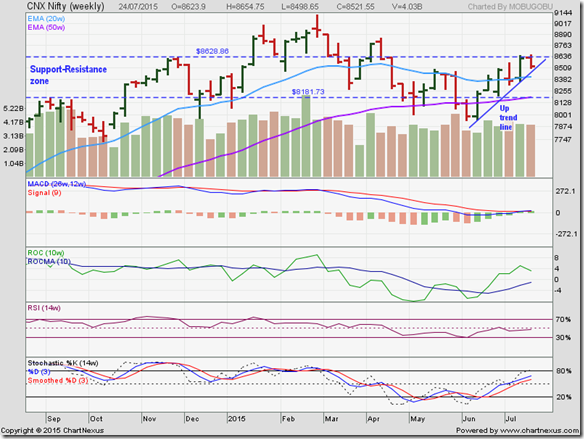

NSE Nifty 50 index chart

The weekly bar chart pattern of Nifty crossed above the ‘support-resistance zone’, touching an intra-week high of 8655 but falling just short of the 61.8% Fibonacci retracement level of 8670. Lack of volume support caused a drop towards the blue up trend line.

Weekly technical indicators are giving mixed signals. MACD has merged with its falling signal line just inside positive zone. ROC has corrected down from its overbought zone. RSI is trying to move above its 50% level. Slow stochastic is rising towards its overbought zone.

Nifty continues to trade above its two weekly EMAs in a bull market, but bears are strongly defending the resistance level of 8630. Expect the battle to continue next week, with bears having a slight advantage.

Bottomline? The bar chart patterns of Sensex and Nifty have been in 6 weeks long up trends, but are facing strong bear resistance. Long-term trends remain bullish, so dips are providing adding opportunities. Choose ‘good’ stocks and maintain suitable stop-losses.

No comments:

Post a Comment