One of the ‘rules’ of the stock market – keeping in mind that stock market ‘rules’ are really empirical observations – is that the holdings of small investors in a company’s stock is inversely proportional to the fundamental strength of the stock.

For those who are mathematically challenged, it means that the better the company the lower is the holding of small investors, and vice versa. Two notable examples of this ‘rule’ are the stocks of Havell’s India and Marico Ltd.

A quick look at fundamentals: Havell’s has a net margin of 10%, RoE of 22.5%, debt/equity ratio of 0.07 and P/E of 36.2; Marico has a net margin of 14.7%, RoE of 29.2%, debt/equity ratio of 0.21 and P/E of 44.7. Both have positive cash flows from operations. Share holding of general public? 6.6% in Havell’s, and 3.6% in Marico.

Some may argue that high P/E ratios deter small investors from investing in such stocks. Really? Then how can you explain the 37.5% holding of the general public (which is more than the combined holdings of Indian and foreign promoters) in Punj Lloyd, which has a net margin of 0.1%, RoE of 0.2%, debt/equity ratio of 1.26 and a whopping P/E of 122?

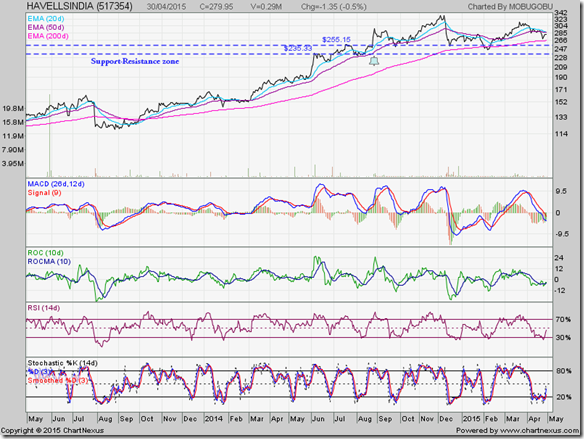

Havell’s India

The 2 years closing chart pattern of Havell’s spent a couple of months (Aug-Sep ‘13) in bear territory before entering a strong bull rally that culminated with a small double-top reversal pattern at 333 (adjusted for 5:1 split) in Dec ‘14.

The stock has been in a sideways consolidation since then – receiving good support from the ‘support-resistance zone’ between 235 and 255. The stock has dropped below its 20 day and 50 day EMAs, but bounced up from its 200 day EMA.

Daily technical indicators are in bearish zones, but showing signs of recovery. This may be a good opportunity to enter/add to existing holdings.

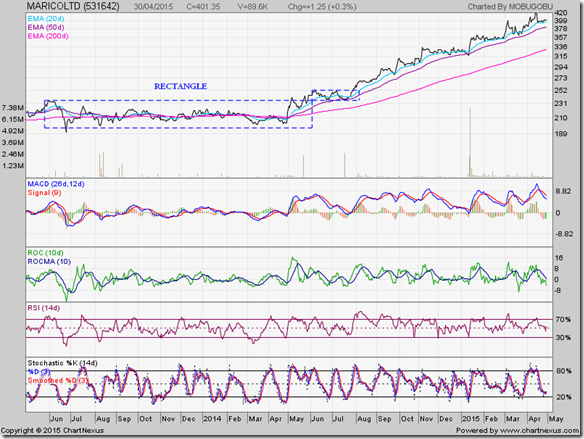

Marico Ltd

The 2 years closing chart pattern of Marico spent a year consolidating sideways within a ‘rectangle’ pattern – finally breaking out upwards with a strong volume surge. It spent the next 2 months in another consolidation within a smaller ‘rectangle’ before rallying strongly to touch a high of 419 on Apr 16 ‘15.

A brief correction down to its rising 20 day EMA has removed overbought conditions, setting the stock up for resuming its up move.

Daily technical indicators are looking bearish, but trying to reverse direction. The stock is in a clear ‘buy on dips’ rally.

(If you are one of the unfortunate souls still mired in Punj Lloyd, get out now and get into Havell’s or Marico. You will thank me after 5 years.)

1 comment:

Havells to buy 51% stake in LED light maker Promptec Renewable

http://www.business-standard.com/content/b2b-manufacturing-industry/havells-to-buy-51-stake-in-led-light-maker-promptec-renewable-115042100299_1.html

Post a Comment