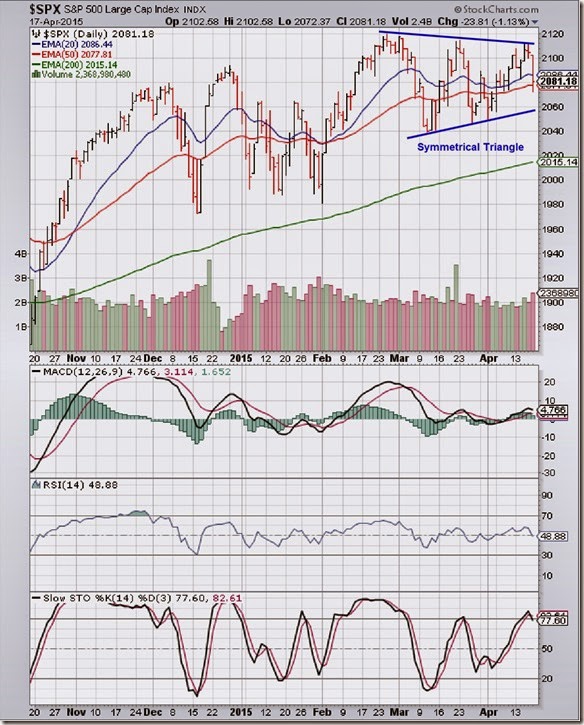

S&P 500 Index Chart

The daily bar chart pattern of S&P 500 continued its sideways consolidation within a ‘symmetrical triangle’ pattern. The index faced resistance from the upper edge of the triangle and dropped sharply below its 20 day EMA, but managed to close above its 50 day EMA – losing 1% on a weekly basis.

The index is trading well above its rising 200 day EMA in a bull market. So, the expected break out from the ‘symmetrical triangle’ – which is usually a continuation pattern – is upwards. But since triangles tend to be unreliable, it would be prudent to wait for the break out before deciding to buy or sell.

Technical indicators are showing a bit of weakness. MACD has started to fall towards its signal line in positive zone. RSI has slipped below its 50% level. Slow stochastic has dropped down from its overbought zone.

Expect the index to consolidate sideways a little longer.

On longer term weekly chart (not shown), the index formed a ‘reversal week’ bar (higher high, lower close), but closed above its three weekly EMAs in a long-term bull market. Weekly technical indicators are in bullish zones, but MACD and RSI are showing downward momentum.

FTSE 100 Index Chart

The daily bar chart pattern of FTSE 100 closed at a lifetime high of 7097 on Wed. Apr 15. The next day it rose to touch a new intra-week high of 7119, but formed a ‘reversal day’ bar (higher high, lower close), and dropped to seek support from its 20 day EMA.

At the time of writing this post, the index has bounced up to trade above the 7000 level and its three daily EMAs in a bull market. Bears are not completely out of the game, as the index continues to trade within a large bearish ‘rising wedge’ pattern since the beginning of the year.

Technical indicators are in bullish zones but showing downward momentum. All three showed negative divergences by failing to touch new highs with the index.

On longer term weekly chart (not shown), the index touched a lifetime high but formed a ‘reversal week’ bar and closed below 7000. The index is trading well above its three rising weekly EMAs in a long-term bull market. Weekly technical indicators are in bullish zones, but showed negative divergences by failing to touch new highs with the index. The market may be getting set up for a big bear attack – so, stay invested but remain cautious.

No comments:

Post a Comment