For the financial year ended Mar 31 ‘14, India’s exports grew by 4% (to $312.35 Bn); imports dropped by 8% (to $450.94 Bn), leading to a 27% drop in the trade deficit. However, for the month of Mar ‘14 the trade deficit rose by 29% over Feb ‘14 due to lower exports. With visible recovery in the global economy, exports are likely to pick up in the current year.

The IIP number dropped to –1.9% in Feb ‘14 – its lowest level in 5 months – because of a sharp 3.7% YoY drop in manufacturing production. Car and CV sales contracted. Consumer demand and investment environment remains weak. It will be a real challenge for the new government to put economic growth back on rails.

Sensex and Nifty continued their climb over a wall of worry – as a bull market is prone to do. Both indices touched new lifetime highs during the week. What should small investors do when indices touch new highs but there is not much euphoria? Let us see what the charts are suggesting.

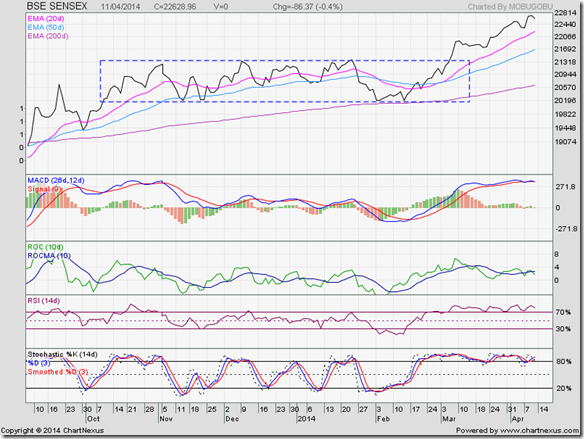

BSE Sensex index chart

After breaking out of the ‘rectangle’ pattern 5 weeks ago, the daily closing chart pattern of Sensex has continued to move up above its three rising EMAs – a clear sign that bulls are in control. Note that it hasn’t been a one way rise. A few days of sideways consolidation and a couple of short corrections have provided adding opportunities.

Daily technical indicators are bullish. MACD, RSI and Slow stochastic are in their overbought zones. Only ROC is showing a bit of bearishness by crossing below its 10 day MA in positive territory. Is there a possibility of a sharp correction – like what happened in global markets?

Corrections are part and parcel of trading in the stock market – and can happen at any time for no particular reason. One must learn to take them in stride. The best way is to have an asset allocation plan and a slightly-detached long-term view.

Remember that despite poor governance, rampant corruption, bureaucratic red-tape, high interest rates India’s economy continues to grow, albeit at a lower rate. The better managed companies are improving their top and bottom lines. Sensex is reflecting that.

NSE Nifty 50 index chart

The weekly bar chart pattern of Nifty touched new lifetime highs on intra-week and closing basis. Despite a holiday-shortened trading week, volumes were very strong. Anecdotal evidence suggests that retail investors are returning to the market.

All four technical indicators are in their overbought zones, which could lead to a correction or consolidation. The index is clearly in a long-term bull market, as it is trading above the long-term up trend line and its two rising weekly EMAs. Any correction or consolidation can be used to add.

Many small investors make the mistake of buying too late and selling too soon. Investment is all about building wealth over the long term with a proper plan. Frequently moving in and out of the market with small gains makes your broker rich.

Bottomline? Chart patterns of BSE Sensex and NSE Nifty indices are in the firm grip of bulls. One makes money in a bull market by picking stocks carefully and staying long. If you are thinking about selling and buying back at a lower rate – drop the idea. That strategy is meant for a bear market.

No comments:

Post a Comment