FIIs were net buyers during all 5 days of the week – for the first time in Feb ‘14. However, they remain net sellers in Feb ‘14. DIIs have turned net sellers. Forex reserves were up by $1.45 Billion. Glaxo Pharma’s ongoing open offer should add to the forex kitty.

The selling in emerging markets by FIIs seems to have abated, but the subsequent buying hasn’t been strong enough to move Sensex and Nifty out of their rectangular consolidation zones. Both indices are trading above their long-term moving averages. Fears of a big crash have subsided.

With Q3 results out of the way, all eyes will be on the forthcoming general elections. The latest opinion polls show that NDA is likely to gain more seats at the expense of UPA, but may fall about 35-40 seats short of a majority. The uncertainty of either a hung parliament or a weak coalition is keeping buying interest in check.

BSE Sensex index chart

The daily bar chart pattern of Sensex is struggling to climb above its 20 day and 50 day EMAs because of resistance from the 20750 level (which happens to be at the middle of the rectangle). It is often seen on price charts that the mid-point of a rectangle acts as a support/resistance level.

Daily technical indicators are looking bullish. MACD has crossed above its signal line in negative zone, with the signal line forming a bullish ‘rounding bottom’ pattern. ROC is positive and above its 10 day MA, which has formed a ‘rounding bottom’ bullish pattern. RSI has moved up to the edge of its overbought zone. Slow stochastic is inside its overbought zone, but showing a slowdown in upward momentum.

The index may try to cross above the 20750 level, but is unlikely to break out from the rectangle in a hurry. Hold on to your portfolios or add selectively.

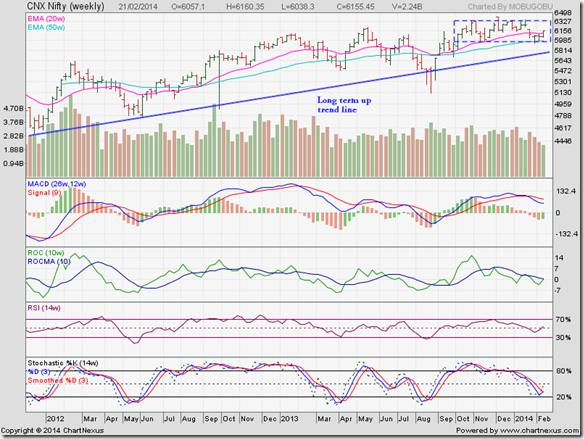

NSE Nifty 50 index chart

The weekly bar chart pattern of Nifty has closed above its 20 week and 50 week EMAs in a clear sign that bulls are regaining control. However, sliding volumes raises concerns that Nifty may not be able to break out above the rectangular consolidation zone any time soon.

The long-term up-trend line (in blue) is intact, which means the up-trend that started from the low touched back in Dec ‘11 remains in force. There is an old stock market adage: “The trend is your friend.” Remember it.

Weekly technical indicators are beginning to give bullish signals. MACD is falling below its signal line in positive territory, but not as rapidly as earlier. ROC is about to cross above its 10 week MA into positive territory. RSI has moved above its 50% level. Slow stochastic has bounced up from near the edge of its oversold zone.

Bottomline? Chart patterns of BSE Sensex and NSE Nifty indices continue to trade within ‘rectangle’ consolidation patterns. Longer they consolidate, stronger will be the eventual breakout. Both indices are in long-term bull markets. Dips provide opportunities to add fundamentally strong stocks. Maintain suitable stop-losses in case bears become active.

No comments:

Post a Comment