The answer to that question has already been provided in the previous update on FMCG sector stocks: “FMCG is my favourite sector to invest in, regardless of the state of the stock market and the economy. Strong brands, positive cash flows, low debt, generous dividends, bonus issues and stock splits make this sector worth every Rupee you invest in it.”

The secret to making money in the stock market was revealed by Warren Buffett: Be fearful when others are greedy and be greedy when others are fearful. In investing terms, it means buy when there are a lot of sellers and sell when there are a lot of buyers. That doesn’t mean all the stocks in a sector are worth buying – one has to use discretion.

Given below are the daily closing chart patterns of 10 stocks from the FMCG sector for the period Nov ‘10 till date. The period was chosen for comparison with the Sensex, which touched its all-time high in Nov ‘10 and is currently trading almost 20% lower.

Brittania

Brittania’s chart looks very bullish, but ripe for a correction. After dropping below all three EMAs in Feb ‘11, the stock spiked up sharply in May ‘11 after all three EMAs came close together (marked by light blue oval). Several months of sideways consolidation was followed by another sharp up move in Feb ‘12. However, all four technical indicators touched lower tops as the stock moved higher. The negative divergences can lead to a correction. Use the likely dip to enter.

Colgate-Palmolive

After briefly slipping below its three EMAs in Feb ‘11, Colgate’s stock has been in a steady up move, touching higher tops and higher bottoms. Negative divergences in all four technical indicators can cause a correction or sideways consolidation. This is a stock that one can buy on a regular basis instead of chasing after mythical multibaggers.

Dabur India

Dabur’s stock hasn’t performed as well as its MNC peers, but it has still outperformed the Sensex by moving higher than its Nov ‘10 high. The stock had a long correction from its Jun ‘11 peak to its Jan ‘12 trough – probably due to the unrest in the Middle East where Dabur has manufacturing and distribution facilities. The stock appears to be resuming its bull market and can be bought on dips.

Emami

Emami is the only stock that is trading below its Nov ‘10 peak. Though it reached a higher top in Jul ‘11, the subsequent correction dropped the stock’s price to a lower bottom, which is bearish. The rally from the Jan ‘12 bottom has not yet confirmed a return to a bull market. The technical indicators are looking overbought. The main promoter, who is also a director in a private hospital, was arrested due to a fire incident that caused many deaths. Avoid.

Glaxo Healthcare

Glaxo Healthcare’s stock has been in a steady up trend after the correction from the Nov ‘10 top got support from the rising 200 day EMA. Just goes to show what strong brands (e.g. Horlicks) can do to stock’s fortunes. Technical indicators are looking overbought. Use dips to add.

Godrej Consumer

After trading sideways for more than a year, Godrej Consumer’s stock has finally broken out upwards. Negative divergences in the technical indicators may lead to a correction or consolidation. Dips can be used to enter.

Hindustan Unilever

HUL’s stock formed a bullish cup-and-handle continuation pattern from which it has broken out upwards to touch an all-time high. The cup-and-handle break out has a target of 460. Hold with a trailing stop-loss.

ITC

ITC’s stock dropped below its 200 day EMA in Feb ‘11, giving a great entry opportunity. It recovered quickly and has been in a steady up trend ever since. Of late, the stock has moved up quite rapidly to touch an all-time high and is looking overbought. Hold with a trailing stop-loss.

Marico

Marico’s stock price is in a bull market. It formed a cup-and-handle continuation pattern from which it has broken out upwards. The upward target is 196. Hold with a trailing stop-loss.

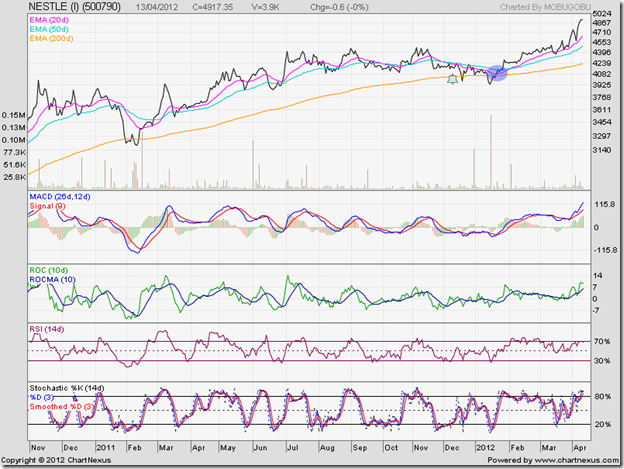

Nestle

Nestle’s stock chart pattern should be an example for those who don’t believe in a long-term buy-and-hold investment strategy. Buy-and-hold doesn’t work for all stocks, but stalwart stocks can give fabulous returns over many years. This is another stock that can be added on a regular basis.

Related Post

2 comments:

Kindly analyse Gooderick tea chart.Recentaly it is moving high.

The stock has reached a long-term resistance level and looking overbought. A good time to take some profits off the table.

Post a Comment