FTSE 100 Index Chart

The FTSE 100 index chart pattern spent a few days in bullish territory, but decided things weren’t quite right with the economy and is heading back down towards bear country. What had appeared to be a bullish inverse head-and-shoulders pattern seems to have failed because of the lack of volume support.

Note the volume spike on Tuesday, Jul 27 ‘10 when the FTSE 100 crossed the 5400 level intra-day to 5411 – just below the May ‘10 top of 5435. But it closed much lower at 5366. A sign of buying exhaustion.

Wednesday’s down day on good volumes confirmed that the bears were getting things back under control. By Friday’s close, the index was back below the 5300 level at 5258, just above the 200 day EMA. It lost 1% on a weekly basis.

The slow stochastic has dipped below the overbought zone. The MACD is positive and above the signal line, but has stopped rising. The RSI has dropped after touching the overbought zone. The MFI has slipped below the 50% level.

All is not lost for the bulls yet. Note the bunching together of the three EMAs just above the 5200 level. This could lead to an up move next week. But without volume support, the rally is likely to fizzle out.

DAX Index Chart

The DAX index chart pattern is not facing as much bear trouble as the FTSE 100, but the bulls are not getting a free ride either. The index failed to make a new high and started to drop towards the 6100 level and the 20 day EMA. It lost 18 points on a weekly basis.

The slight bounce up on Friday has kept the bears at bay. The index has formed an ascending triangle pattern with the flat top at 6200 and rising bottoms. The likely break out is above the 6200 level to test the Jun ‘10 high of 6331.

The technical indicators haven’t turned bearish. The MACD is still positive and above the signal line. The RSI has moved down but remains above the 50% level. Likewise for the MFI. The slow stochastic touched the overbought zone and slipped down but the %K hasn’t crossed below the %D line.

The DAX index continues with its sideways consolidation in a bull market, as it remains well above the rising 200 day EMA.

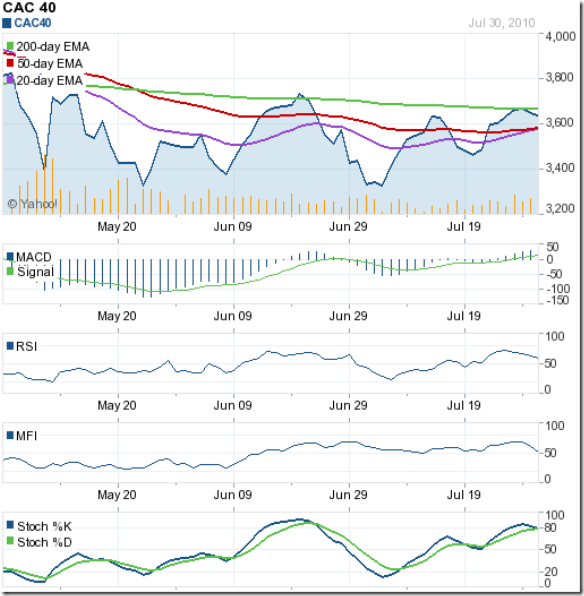

CAC 40 Index Chart

The CAC 40 index chart pattern managed to move above the 200 day EMA three days in a row on an intra-day basis, but couldn’t quite close above it and is down in bear country once again. It closed 36 points higher on a weekly basis, keeping bullish hopes alive.

The 20 day EMA is about to cross above the 50 day EMA, and both are rising. The technical indicators are mildly bullish. The MACD is in positive territory and above the signal line. The RSI is sliding but remains above the 50% level. The MFI has dropped to the 50% level. The slow stochastic is about to drop from the overbought zone.

The CAC 40 has made a bullish pattern of higher tops and higher bottoms since the rally started in early Jul ‘10. As long as the index remains above the Jul 20 ‘10 low of 3420, bears will not regain full control.

Bottomline? The chart patterns of the European indices show that the month-long bullish rally may be petering out due to a lack of follow-up buying. Alternative bouts of bull and bear dominance is frustrating investors no end. Stay invested with tight stop-losses. Any buying should be very selective.

No comments:

Post a Comment