In last week’s analysis of the Dow Jones (DJIA) index chart pattern, I had mentioned about the significance of the 10655 level – the 61.8% Fibonacci retracement level of the correction from the Apr ‘10 top of 11309 to the Jul ‘10 low of 9596.

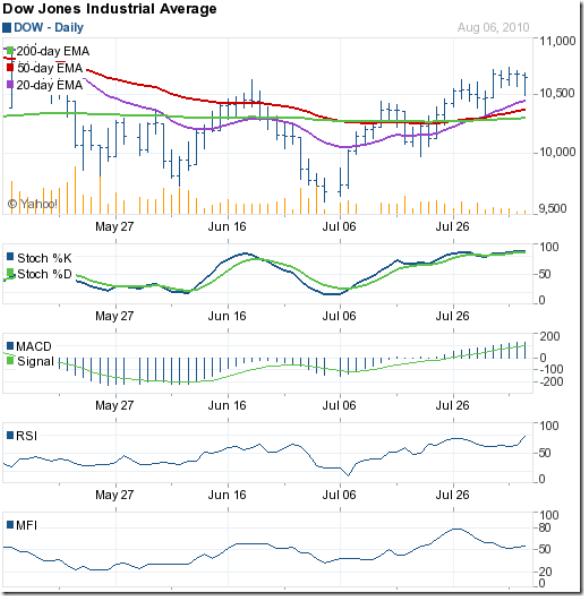

The logic behind the 61.8% Fibonacci retracement level is that once the chart moves above that level, the correction is deemed to be over. Let us now look at the 3 months bar chart pattern of the Dow Jones (DJIA) index:

The index rose above the 10655 level on intra-day basis on all 5 days of the week. On Monday, Wednesday and Thursday (Aug 2, 4, 5 ‘10), it managed to close higher than the 10655 level. On Tuesday, it closed marginally below.

On Friday, following the disappointing employment report, the Dow fell sharply below the 10500 level. But it recovered smartly to close bang on the 10655 level – a 190 points higher close on a weekly basis. But technically, the 10655 level has not been overcome.

It doesn’t cease to amaze me how the 61.8% Fibonacci retracement level becomes the battle line between the bulls and bears so often. There is a logical explanation (if such a thing exists for stock market behaviour!). Both sides are equally aware of this important technical level.

So, is the Dow headed up or down from here? That’s a million dollar question. The technical indicators are mostly favouring the bulls. The 50 day EMA has moved above the 200 day EMA – the final confirmation of a return to the bull market. All three EMAs are moving up with the index above them.

The slow stochastic is inside the overbought zone. The MACD is positive and above the signal line. The RSI is about to enter its overbought zone. The MFI is just above the 50% level, but showing negative divergence – it failed to make a new high with the index.

The bears haven’t quite run out of ammunition yet. Volumes have dwindled during the rally from the Jul ‘10 low – not a good sign for sustainability of a bull market. The index has been trading inside an ascending wedge pattern. It tried to break downwards from it on Friday, but failed.

The economic recovery is more like a mirage. Employment news is bad, housing news is bad, consumer sentiment is bad. Quarterly results of companies were good, but only in comparison with much lower figures of last year. Still the index keeps moving up.

Is this disconnect between the economy and the stock market an aberration? Why worry about it? Maintain trailing stop losses and stay invested. Any buying should be very selective.

Bottomline? The chart pattern of the Dow Jones (DJIA) index is looking quite bullish. The immediate hurdle for the bulls will be the Apr ‘10 top of 11309. Stay invested, book part profits but please do not short-sell this market.

No comments:

Post a Comment