Expectations of a mid-year interest rate hike in the US propelled the US Dollar to new highs against global currencies. ECB began its bond buying (QE) programme with freshly printed money – further weakening the Euro against the Dollar.

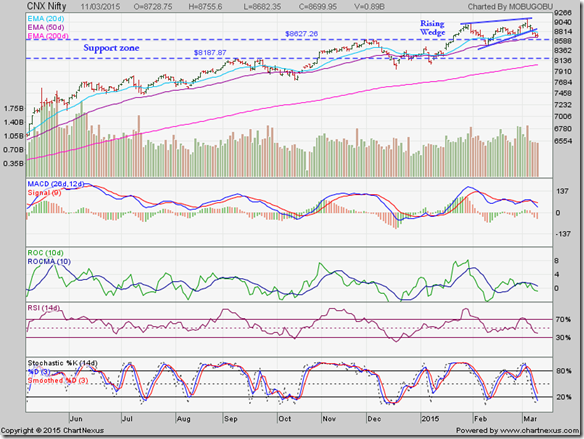

FIIs switched to ‘sell’ mode – their net selling during the past two days was worth nearly Rs 1200 Crores. DIIs seem confused – buying and selling on alternate days. Nifty broke down below the bearish ‘rising wedge’ pattern (mentioned in an earlier post) within which it has been trading since the end of Jan ‘15.

The coal block and telecom spectrum auctions appear to be going well for the government. The large amounts raised should put a significant dent on India’s fiscal deficit, and allow investments in much-needed infrastructure projects.

The daily bar chart pattern of Nifty dropped below the ‘wedge’ and the 20 day EMA, but has received good support from the 50 day EMA so far. The support zone (marked by blue dotted lines on chart) between 8180 and 8630 should provide stronger support in case the index corrects some more.

An unscheduled 25 bps interest rate cut and a less-than-exciting budget has been already ‘discounted’ by the stock market. Q4 results - to be announced next month - may continue the disappointing trend set by Q3 results. Any positive triggers to boost bullish sentiments need to come from external sources.

Daily technical indicators are looking bearish. MACD is falling below its signal line in positive territory. ROC has dropped inside negative zone. RSI is below its 50% level. Slow stochastic has entered its oversold zone.

The index has corrected less than 5% from its lifetime high of 9119 (touched on Mar 4 ‘15). Some more correction is possible. Before you sell in a panic, remember that the index is trading well above its rising 200 day EMA in a long-term bull market. Periodic corrections have kept the chart ‘technically healthy’.

If you have already booked partial profits, redeploy the proceeds in a gilt fund or income fund instead of looking for new ideas near a market top. In a falling interest rate regime, long-term debt funds ought to do well – and also protect the downside.

No comments:

Post a Comment