FIIs turned net buyers of equity on Fri. Feb 13 after being net sellers since the beginning of the month. Their net selling has totalled Rs 3400 Crores. DIIs continued to buy – their net buying for Feb ‘15 totalling Rs 2300 Crores so far. Both Sensex and Nifty have bounced up from their respective support-resistance zones.

CPI inflation for Jan ‘15 rose to 5.11% YoY compared with 4.28% in Dec ‘14. This was lower than estimates because the base year and the method of calculation have been changed. The IIP number for Dec ‘14 was lower at 1.7% compared with 3.9% in Nov ‘14. The figures show that economic growth remains tepid.

The trade deficit narrowed, as both exports and imports were lower. Forex reserves have touched a record level of $330 Billion. Q3 results have been disappointing on the whole. SBI’s result was one of the few positive surprises last week.

BSE Sensex index chart

The daily bar chart pattern of Sensex received good support from its 50 day EMA and bounced up to close above the support-resistance zone between 27350 and 28800. The index has corrected nearly 61.8% of its 1800 points fall from 29844 on Jan 30 to 28044 on Feb 10.

All three EMAs are rising, and Sensex is trading above them in a long-term bull market. However, bulls will need to ensure that the index crosses above its Jan ‘15 top of 29844 to regain control.

Daily technical indicators are showing bullish signs. MACD is below its signal line in positive zone, but has formed a small bullish ‘rounding bottom’ pattern. ROC bounced up from the edge of its oversold zone to cross above its falling 10 day MA, and is poised to enter positive territory. RSI and Slow stochastic are rising towards their respective 50% levels.

Bears may try to put up a fight near 29800, but may not be able to prevent the index from touching new highs soon.

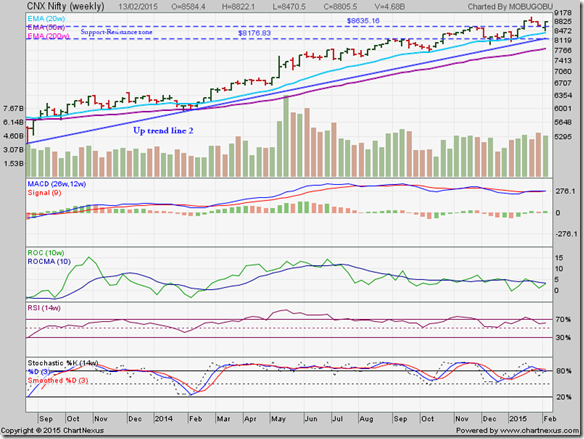

NSE Nifty 50 index chart

The weekly bar chart pattern of Nifty barely tested its rising 20 week EMA, formed a ‘reversal week’ (lower low, higher close) pattern, and emerged from its brief dip inside the support-resistance zone between 8180 and 8630.

The two weekly EMAs are rising, and the index is trading above them in a long-term bull market. The previous top of 8997 – touched in the week ending on Jan 30 ‘15 – needs to be crossed convincingly for bulls to regain control.

Weekly technical indicators are looking bullish. MACD remains entangled with its signal line at the edge of its overbought zone. ROC has moved up to touch its 10 week MA in positive territory. RSI is gradually rising towards its overbought zone. Slow stochastic has slipped down from its overbought zone.

The stage has been nicely set for a pre-budget rally.

Bottomline? Chart patterns of BSE Sensex and NSE Nifty indices appear to have completed their corrections, and should move up to touch new lifetime highs. Such corrections in bull markets provide opportunities to add. However, near a lifetime high, it may be better to choose a diversified equity fund or a balanced fund instead of trying your luck with individual stocks.

No comments:

Post a Comment