There was good news and bad news in a holiday-shortened trading week that saw increased volatility due to F&O settlement. First the good news. India’s GDP growth rate for 2013-14 was revised upwards from 4.7% to 6.9% by including some unrepresented sectors and products in the method of calculating GDP. So, the economic situation was not as bleak as it was made out to be.

Now, the bad news. Q3 results from NBFCs and banks clearly show bottom line pressure and increase in NPAs. Since the financial institutions are expected to spur the next stage of the country’s growth, stress on their balance sheets do not bode well for the future. Large share divestments till Mar ‘15 – from Coal India and other PSU units in the pipeline – may put a lid on a pre-budget rally.

For the month of Jan ‘15, FIIs were net buyers of equity worth Rs 8500 Crores. DIIs were net sellers of equity worth Rs 6500 Crores. Despite the sharp corrections on Friday (Jan 30), Sensex and Nifty closed slightly lower for the week after touching new lifetime highs. For the month, Sensex gained 6.1% and Nifty gained 6.3%.

BSE Sensex index chart

The daily bar chart pattern of Sensex had closed at a lifetime high of 29682 on Thu. Jan 29. The next day, it touched a new lifetime intraday high of 29844 but closed nearly 500 points lower at 29183 – forming a ‘reversal day’ pattern that appears to have ended the intermediate rally of more than 3000 points from the low of 26776 touched on Jan 7 ‘15.

Sensex can correct some more. Daily technical indicators are still within their respective overbought zones, but their upward momentum have stalled. The zone between 27350 and 28800 (the previous tops touched in Sep ‘14 and Nov ‘14 respectively) should act as a support on the downside. The 20 day and 50 day EMAs are within the support/resistance zone, and can be expected to provide support as well.

Is there a possibility of the index falling below 27350 (the lower edge of the support/resistance zone)? Nothing can be ruled out in the stock market – but the chances of that happening are low. Corrections are part and parcel of bull markets, and should be used as opportunities to add to existing holdings. Searching for new ideas near a market top can be a time-consuming and futile effort.

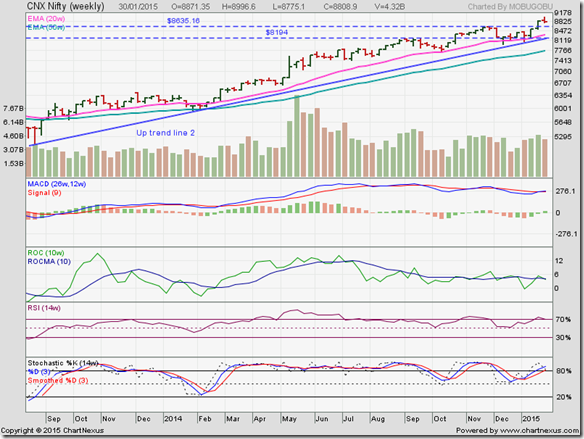

NSE Nifty 50 index chart

The weekly bar chart pattern of Nifty had a splendid 930 points rally – from the intraweek low of 8065 touched on the week ending on Jan 9 to an intraweek high that was a hairs’ breadth short of the 9000 level – but formed a ‘reversal week’ pattern (higher high, lower close). Expect the index to correct or consolidate a bit before the up trend is resumed.

The support/resistance zone between 8180 (top in week ending on Sep 12 ‘14) and 8630 (top in week ending on Dec 5 ‘14) should provide support on the downside. The 20 week EMA is within the support/resistance zone, and the blue ‘Up trend line 2’ is almost at the lower edge of the zone. That means a fall below 8180 is unlikely.

Weekly technical indicators are correcting overbought conditions. MACD is entangled with its signal line at the edge of its overbought zone. ROC has dropped to touch its 10 week MA just below its overbought zone. RSI has dropped to the edge of its overbought zone. Slow stochastic is inside its overbought zone, but its upward momentum is slowing down.

Nifty is trading well above its two weekly EMAs in a long-term bull market. The correction will improve the technical ‘health’ of the chart, and enable the index to rise even higher.

Bottomline? Chart patterns of BSE Sensex and NSE Nifty indices have corrected after touching new lifetime highs. No need to panic and sell. Periodic corrections are to be expected in a bull market – and taken in stride. If you are planning to enter now, choose a diversified equity fund or a balanced fund instead of trying your luck with individual stocks. Stock picking skills will get tested near market tops.

No comments:

Post a Comment