Now that even die-hard bears are also coming around to the notion that the Indian stock market is in a bull phase – though it has been so since the low of Dec ‘11, it is as good a time as any to look at sectoral performances to assess where to invest.

In a guest post, Niteen analyses data to show the outperforming and underperforming sectors over various time frames. A contrarian approach would be to invest in the underperforming sectors – but not blindly. One still has to be stock specific.

------------------------------------------------------------------------------------------------------------------------------------------

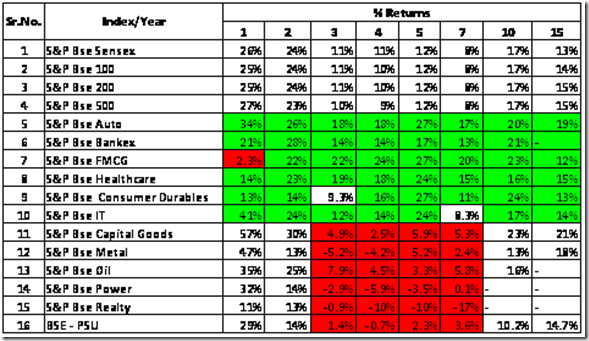

The market is moving fast and especially stocks from ‘beaten down’ sectors have performed really well. So I thought of doing a reality check to see how returns look like for stocks from beaten down sectors compared to what they were when the market had peaked about 5 years ago.

- The sectors which were continuously outperforming include Banking, Healthcare, Consumer Durables, Auto and IT. FMCG also outperformed in all these years except the last one year

- The sectors which underperformed during last 7 years consistently include Capital Goods, Metal, Oil, Power, Realty and PSU

- Capital Goods started performing in last 2 years. But if someone bought a stock which was a part of the Capital Goods index 7 years ago then the person earned just 5% YoY return

- These underperforming sectors were, in a way, just waiting for the right opportunity to give returns and that has happened. The contrarian approach worked well. I have delivered one presentation on Contrarian approach in stock market with a backdrop of Public Sector banks (see here)

- These underperforming sectors might be showing good returns of last one year, but still they are either flat or have given negative returns over a longer period of 3-7 years. So there still is significant value left in these sectors/companies if we could go back to a GDP growth rate of 7% and above prevailing around 5 years ago. This may now look possible considering the systemic risk coming down in the market quickly

- One may also notice that all sectors gave double digit growth over 10 and 15 years durations. It proves the point that longer the holding the better the likely returns

Criteria:

- The returns are CAGR

- Performance benchmark is kept at 10% which is between the Sensex return over 15 years and average inflation rate of 7%

- If returns are lower than 10% then the stocks which were part of the index have underperformed

- If returns are above 10% then the stocks which were part of the index have outperformed

Acknowledgement: Vinit Bolinjkar, founder Academic Toppers (click here), helped me in getting the data for this analysis.

------------------------------------------------------------------------------------------------------------------------------------------

(Niteen is an MBA and cleared CFA Level 2, CFA Institute USA. He also conducts investor education sessions, writes blogs. A firm believer in long-term financial planning, and a 20 years veteran of the stock market, he likes to analyse the economy, and individual stocks.

Niteen blogs at Investment ideas.)

No comments:

Post a Comment