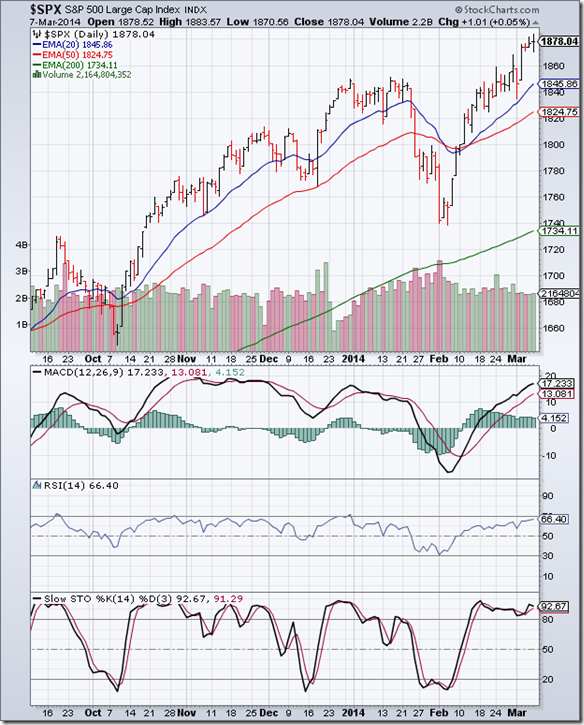

S&P 500 Index Chart

The bull rally from the Feb ‘14 low of 1740 continued unabated. The daily bar chart pattern of S&P 500 rose to touch new lifetime intra-day and closing highs on Mar 7 ‘14. The selling on Mon. Mar 3 – triggered by Russia’s ‘invasion’ of Crimea – subsided after the index received good support from its rising 20 day EMA.

All three EMAs are rising in tandem and the index is trading above them. Bulls are clearly on top. But don’t expect the bears to give further ground without a fight. Several technical indications point to a correction.

Note the volumes. They have been quite flat, with volumes on the 2 down days matching volumes on 3 up days. Volume peaks are coming down as the rally progresses. The index is trading more than 150 points above its 200 day EMA. The last time that happened (in Jan ‘14), a sharp correction followed.

Daily technical indicators are in bullish zones, but looking overbought. MACD is inside its overbought zone and its upward momentum is diminishing. RSI is just below its overbought zone. Slow stochastic has remained inside its overbought zone for almost a month.

The economy keeps growing but sluggishly. New job additions in the private sector and initial jobless claims were lower than expectations. The Services ISM number was also below expectations but showed growth. Looks like the index and the economy are taking QE3 tapering in their strides.

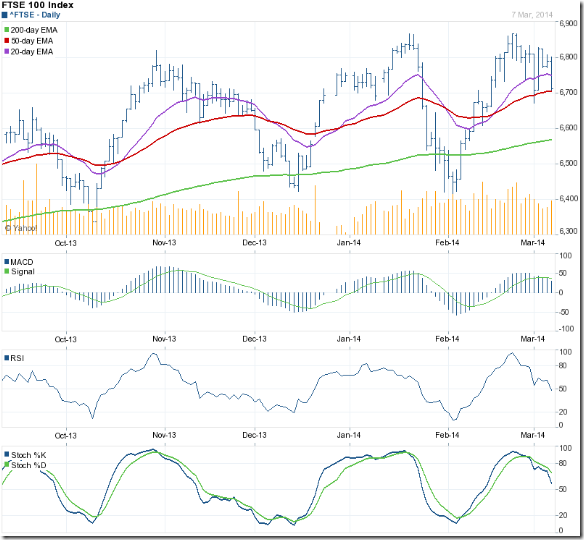

FTSE 100 Index Chart

The daily bar chart pattern of FTSE 100 dropped below the 6700 level and its 50 day EMA (on Mon. Mar 3) as news of Russia’s ‘occupation’ of Crimea shook investor confidence. Fears of a war receded the next day. The index jumped up to close above the 6800 level.

By the end of the week, the index slipped down to test support from its 50 day EMA once again. Though it managed to close above the 6700 level, the index lost almost 100 points for the week.

Daily technical indicators have corrected from overbought conditions and are looking bearish. MACD is still positive, but falling below its signal line. RSI has slipped below its 50% level. Slow stochastic is falling rapidly towards its 50% level. A drop below 6672 (intra-day low on Mar 3) will form a bearish pattern of lower tops and lower bottoms.

Bottomline? Daily bar chart patterns of S&P 500 and FTSE 100 indices are in long-term bull markets. S&P 500 managed to shake off fears of a war in Ukraine by touching a new lifetime high, but is looking overbought. FTSE 100 seems to be in the midst of another corrective move. Stay invested, but be ready to face a correction.

No comments:

Post a Comment