S&P 500 Index Chart

The 6 months daily bar chart of S&P 500 formed a small double-top reversal pattern by almost touching the previous all-time high of 1775, and dropped sharply to its rising 20 day EMA. Strong volumes suggested a deeper correction.

Bulls came charging back the next day – thanks to better-than-expected job additions in October despite the government shutdown. The index gained marginally on a weekly closing basis.

Daily technical indicators remain in bullish zones after correcting overbought conditions. However, caution is advised near an all-time high. Also, the index is 240 points above its 200 day EMA – which is often a precursor to a sharp correction.

One needs to respect a reversal pattern. A rise above 1775 will negate the double-top.

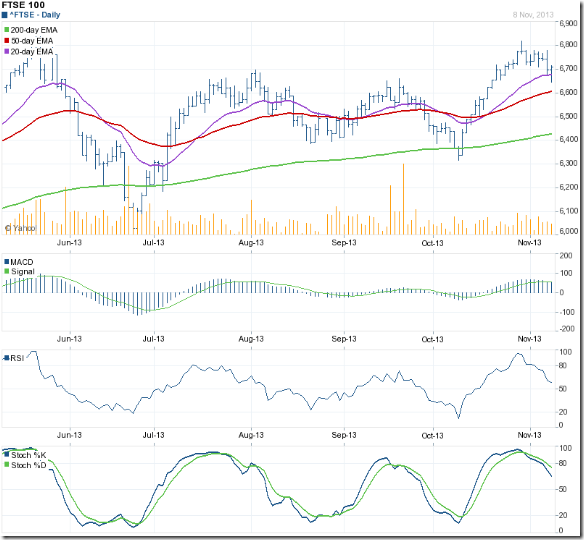

FTSE 100 Index Chart

The 6 months daily bar chart pattern of FTSE 100 dropped below the 6700 level and its 20 day EMA intra-day, but recovered to close above the 6700 level by the end of the week.

Daily technical indicators have corrected overbought conditions. MACD is touching its signal line in positive territory. Both RSI and Slow stochastic have fallen from their overbought zones. Some more correction is possible.

The dip is providing an adding opportunity.

Bottomline? 6 months daily bar chart patterns of S&P 500 and FTSE 100 indices are undergoing a spot of correction after touching new highs. Bull market corrections provide opportunities to add. But maintain appropriate stop-losses.

No comments:

Post a Comment