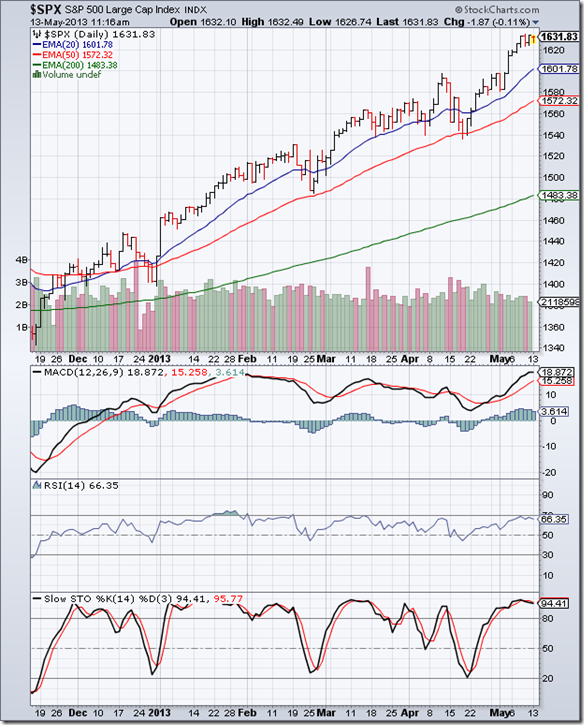

S&P 500 Index Chart

The 6 months daily bar chart pattern of S&P 500 continues to rise relentlessly. It touched a new life-time intra-day high of 1635 on May 9 ‘13, and a new life-time closing daily and weekly high of 1633.70 on May 10 ‘13.

The index is trading above all three EMAs, but appears to be taking a pause. All three EMAs are rising, and there are no immediate threats to the bull market. But some of the concerns raised in last week’s analysis remain. Volumes are not great and the widening gap between the 50 day and 200 day EMAs is unsustainable.

Daily technical indicators are bullish, but beginning to correct from overbought conditions. MACD is above its signal line, but has stopped rising in its overbought zone. RSI has started to drift down after touching the edge of its overbought zone. Slow stochastic has started to slide down inside its overbought zone.

The index appears ripe for another correction. The Fed is planning to wind down the QE3 program – as per an article in the Wall Street Journal. The real mettle of the bulls may get tested soon.

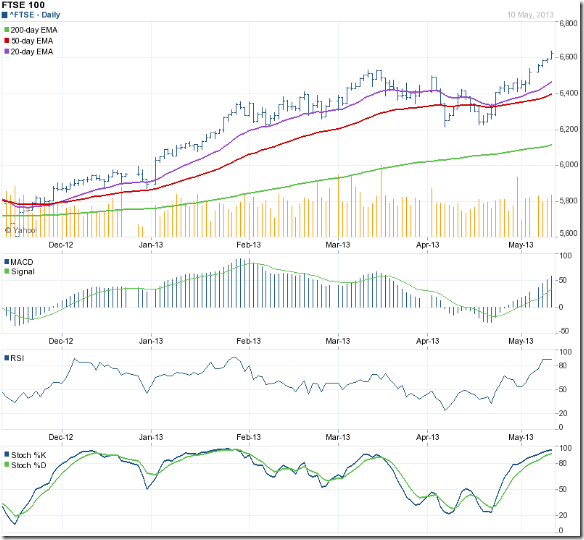

FTSE 100 Index Chart

The 6 months daily bar chart pattern of FTSE 100 index ignored all the warning signs mentioned last week, as it climbed past the 6600 level and closed at a 5 yr high of 6625. The index is now within a stone’s throw of touching a life-time high.

Volumes have picked up. All three daily technical indicators are bullish, but looking overbought. MACD has risen above its signal line into overbought territory. RSI and Slow stochastic are both inside their overbought zones.

The index can stay overbought for extended periods. It is not a good idea to buy when the index is at a new high. So, one can stay invested with a trailing stop-loss.

Bottomline? Bulls continue to rule the daily bar chart patterns of S&P 500 and FTSE 100 indices – touching new highs on a weekly basis. Hold on, with trailing stop-losses to protect profits.

No comments:

Post a Comment