News and views coming out of Europe and USA generally paint a gloomy picture of the economies on both sides of the Atlantic. Europe is still struggling under recessionary conditions. USA has got its neck above the water, but growth has been painfully slow.

In a guest post full of interesting and revealing insights, KKP presents a ground-zero view of where the US economy is headed and how small investors can gear up for the unfolding scenarios.

----------------------------------------------------------------------------------------------------------------------------------------

Macro Level: Good, Bad and Ugly of the US Economy

The best predictor of economic times is the overall results, i.e. GDP. But underneath that layer there is a key measure, and that is manufacturing. Of course, the US GDP at 2.0% and the softness in GDP prediction for Canada says it all…….OK, let me say it: It is weak GDP numbers by all measures, and in the 70’s or 80’s or 90’s, Greenspan would have started lowering the rates to boost production.

Bottom-line is that without manufacturing an iPad, Car, Refrigerator, Engines, Parts etc. there would be no service industry. Manufacturing is key to any GDP number. It is best to follow this truly leading indicator that shows the slow-downs, turn-ups and turn-downs as a great predictor of the times ahead with some level of comfort and confidence. Mix it up with others in this write-up and we will get to know the Good, Bad and Ugly of the situation.

Housing is stronger right now, although Existing Home Sales is weak and has never recovered due to upside-down mortgage situations of thousands of people. Building permits is another great leading indicator. It is costly to get a building permit, so it involves a real commitment. Steven Hansen has a nice analysis of this report (on the net), showing the data from various perspectives. This is the chart that I think is most helpful, so we know that there is hope ahead and America is not doomed for a crash and burn, as many are hoping and predicting. 330 million people are going to be creative, generate productive hours and produce something that they themselves need, and possibly others in the world might use (iPads, Drugs, LEDs, Biotech seeds, etc.).

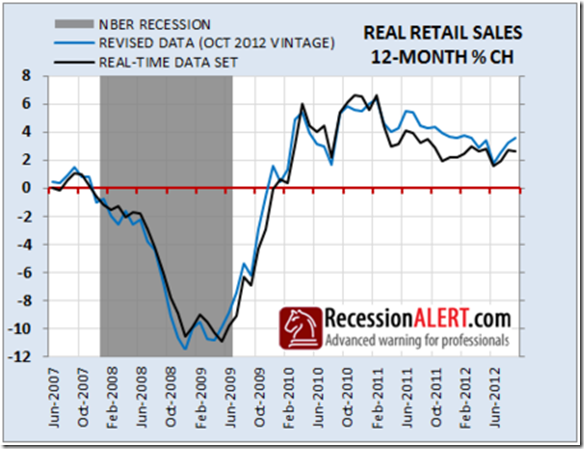

Recent Retail Sales were much stronger, and not consistent with the onset of a recession, which is what makes such analysis very good, since it gives contrary opinions and indications, and it is the human mind that has to decipher it to come to a single conclusion. Are we headed for a recession or slow growth era or a depression? My view is that we will muddle along at the 1% to 2% GDP growth, which is nothing to write home about! The next 2-4 months are going to provide telltale signs of the real happenings since that is when we will be past the Christmas shopping season, and the Elections in the US.

Review this new Recession Resource Graphic which explains many of the concepts people get wrong and what the current status of the US economy is under the covers:

Chinese economic growth is worse than you think, and it is the second most watched economic data since so much of China is humming based on American demand. This week's data may have seemed positive on first blush but the problem is that China uses year-over-year reporting rather than a quarterly report with seasonal adjustments. It is quite possible that China's GDP growth had a "six handle" in Q2, although there might now be a rebound. Stephen Green from Standard Chartered finds the strong export growth is not so impressive either. Green runs his own seasonal adjustment on the data to find it’s sluggish for the pre-Christmas ordering period.

There is a sizeable seasonal effect in September, likely related to Christmas exports. Thankfully, despite their difficulties, the Americans and Europeans still appear to be on track for celebrating in December. The picture looks less impressive in seasonally adjusted (SA) terms, though, and it is worrisome.

The Financial Times has a totally awesome graphics department. Check out this beauty, showing various aspects of China’s economic shift, and the picture speaks a 1000 words here on China:

In conclusion, things have improved on a comparative year over year basis, but we are at the delicate point where we need to come out of the cave and show our might, and if we cannot do so through the Christmas season with a strong President, we are doomed to get back into recession, and drag the entire world into it also. Companies like Tata, Infosys/Wipro/TCS, Auto-parts, Call Centers etc. are going to see the immediate effect of it. Also, the USD taking a nose dive will start to affect the currency translations, and hence create a second domino drop. Once we foresee this happening, news of a GDP reduction in India and China will start circulating and take the markets down with it. So, it is the Ugly that we need to be afraid of since we have the Good and Bad out there now, but, we do not want the Ugly to show up, and just let the Good and Bad shake hands and keep the US economy at the 1% to 2% GDP levels for the next 1-2 years. You draw your own conclusions from the data above, and be ready to make the right moves in the Indian and US market.

----------------------------------------------------------------------------------------------------------------------------------------

KKP (Kiran Patel) is a long time investor in the US, investing in US, Indian and Chinese markets for the last 25 years. Investing is a passion, and most recently he has ventured into real estate in the US and also a bit in India. Running user groups, teaching kids at local high school, moderating a group in the US and running Investment Clubs are his current hobbies. He also works full time for a Fortune 100 corporation.

No comments:

Post a Comment