The Sensex bottomed out in Dec ‘11 after more than 13 months of a bear phase. In Jun ‘12, it formed a higher bottom and has been in an uptrend ever since. Technically, it looks like the early stage of a new bull market in the Sensex.

Though the index is trading more than 10% below its Nov ‘10 top, many stocks have touched their all-time highs – thanks to relentless buying by FIIs. There have been some doubts about the real source of such FII inflows. Apparently, a lot of black money is being funneled out through ‘hawala’ routes and round-tripping back into the country in the garb of FII investments.

Where are the ‘real’ FIIs buying? A look at the 1 year closing chart patterns of some global indices may provide some clues.

Brazil IBOVESPA vs. SENSEX (in green)

After outperforming the Sensex till May ‘12, Brazil’s IBOVESPA index has underperformed for the past 6 months. Some FII money may have been diverted from Brazil to India of late.

Russia RTSI vs. SENSEX (in green)

Russia’s RTSI index was an equal performer with the Sensex till Feb ‘12 before outperforming in Apr and May ‘12. Since Jun ‘12, Sensex has outperformed the Russian index. Some FIIs may have booked profits and invested in India.

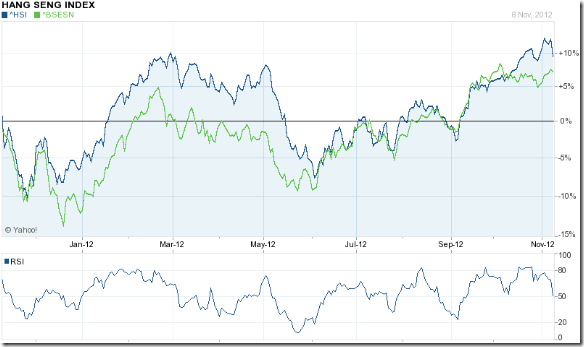

Hang Seng vs. SENSEX (in green)

The Hang Seng index was an equal performer in Nov ‘11 and again during Jun to Sep ‘12. It has outperformed the Sensex during the other 7 months.

Jakarta Composite vs. SENSEX (in green)

Indonesia’s Jakarta Composite index has comfortably outperformed the Sensex during the past year, clearly indicating which market the ‘real’ FIIs prefer.

Germany DAX vs. SENSEX (in green)

Despite the economic woes in Europe, Germany’s DAX index has clearly outperformed the Sensex during the previous 12 months. Is this an indication that India’s so-called economic growth doesn’t have many takers among ‘real’ FIIs?

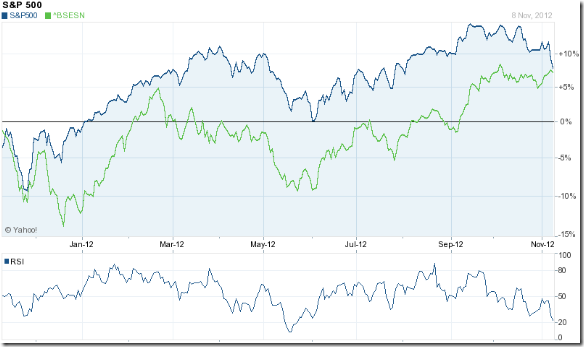

S&P 500 vs. SENSEX (in green)

Only during Nov ‘11, and during the recent correction, was the Sensex able to keep up with the S&P 500 index. The slow growth and high unemployment in the US economy hasn’t shaken the faith of FIIs in their home market.

No comments:

Post a Comment