There is good news and bad news for investors who track the Nifty index closely. First the good news:

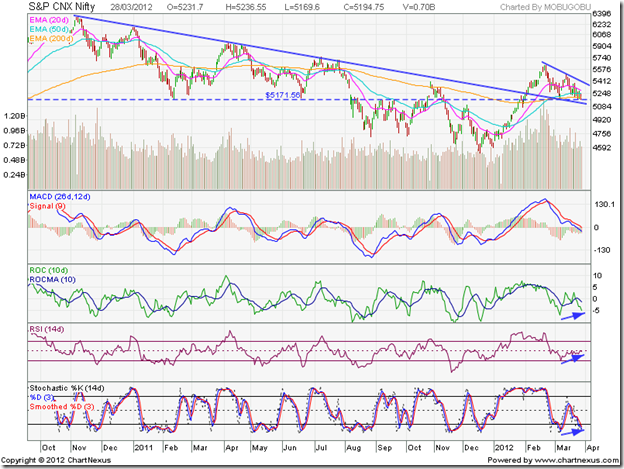

1. The Nifty is testing support from the long-term support-resistance level of 5170;

2. Just below the 5170 level is the blue down trend line, which is currently at 5120 and should provide support in case 5170 gets breached;

3. The 50 day EMA is still above the 200 day EMA;

4. There are positive divergences in three of the four technical indicators which have reached higher bottoms while the Nifty touched a slightly lower bottom;

5. Last, but not the least, the Nifty appears to be consolidating within a ‘falling wedge’ pattern, which has bullish implications.

Now, the bad news:

1. For the second time in three days, the Nifty closed below the 200 day EMA;

2. The 20 day and 50 day EMAs are falling, and the 50 day EMA seems all set to cross below the 200 day EMA (like it did in May ‘11);

3. In case the Nifty falls below the blue down trend line, there is no real support – except for the 50% Fibonacci retracement level (5080) of the entire Dec ‘11 to Feb ‘12 rally;

4. The technical indicators are bearish. The MACD is below its signal line and has dropped into negative territory. The ROC is negative and below its 10 day MA. The slow stochastic has fallen back inside its oversold zone. Only the RSI – which has risen from the edge of its oversold zone to the 50% level - is neutral;

5. What appears to be a bullish ‘falling wedge’ can very well turn out to be a bearish ‘descending triangle’ pattern, with the 5170 level acting as the horizontal side of the triangle.

The good news and bad news have nullified each other, leaving a big question mark about Nifty’s likely behaviour in this expiry weak. What should investors do? Stay patient and disciplined and stick to your asset allocation plan. The Nifty is dancing to the tune of the FIIs and DIIs. If you try to dance with elephants, the dance is likely to be short-lived!

No comments:

Post a Comment