A few days after the previous post two months back on the chart patterns of BSE’s Sectoral indices, the Sensex touched a bottom and embarked on a two months long rally. It may be a good time to check how the Sectoral indices have fared.

BSE Auto Index

The BSE Auto index received good support from the lower end of the rectangular consolidation zone between 8000 and 9700 and rallied smartly to the upper end of the band earlier in Feb ‘12. After a brief consolidation, the index has broken out to test its Jan ‘11 top.

A pullback down to the top of the rectangular band can be expected. The ‘golden cross’ of the 50 day EMA above the 200 day EMA and more than a 20% rise from its recent bottom have confirmed a return to a bull market. Add on dips.

BSE Bankex

The BSE Bankex has risen more than 40% from its Dec ‘11 low, but is yet to test its 2011 tops. The index has moved well past the support/resistance level of 11400 and its 200 day EMA, but the ‘golden cross’ is still awaited. That should not deter investors from accumulating.

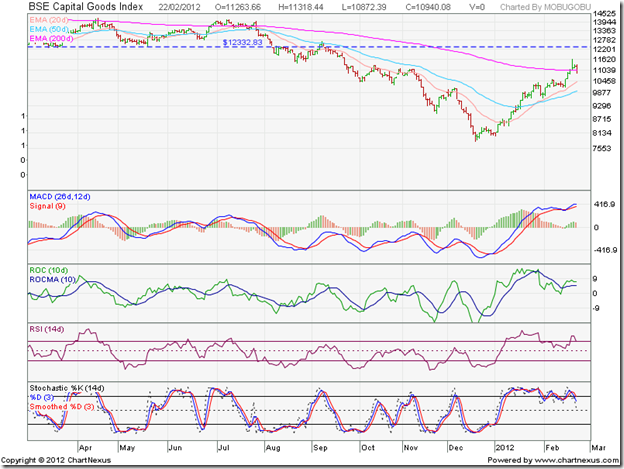

BSE Capital Goods Index

The BSE Capital Goods index is struggling to break the stranglehold of the bears. It is trading below the support/resistance level of 12300 and is yet to convincingly move above its 200 day EMA. Accumulate selectively.

BSE Consumer Durables Index

The BSE Consumer Durables index has risen almost 40% from its Dec ‘11 low and is on the verge of entering a bull market. Three ‘fan lines’ have been drawn through the Nov ‘10 top. Note that the second line drawn through the Apr ‘11 top became a support level in Jun, Aug and Nov ‘11. After getting breached in Dec ‘11, it briefly acted as a resistance level. Accumulate selectively.

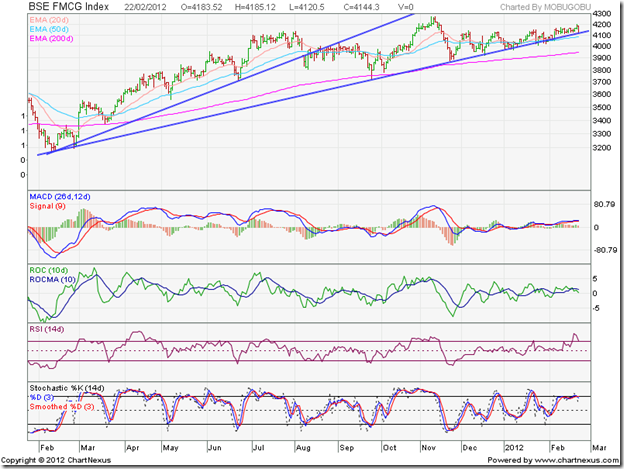

BSE FMCG Index

One look at the BSE FMCG index should make it clear to all why it is my favourite sector. Despite a brief drop below the 200 day EMA in Feb ‘11, the index remained in a bull market and outperformed the Sensex. Nothing spectacular or exciting, just a steady climb along the second fan line. Add on dips.

BSE Healthcare Index

After a 13 months long consolidation within a triangle pattern, the BSE Healthcare index has broken out upwards and returned to a bull market. It is currently consolidating within a small ‘falling wedge’ pattern from which it should break out upwards. Accumulate.

BSE IT Index

The BSE IT index has sailed above the blue down trend line and back into a bull market. The expected slow down in the Eurozone didn’t happen. Add on dips.

BSE Metal Index

The BSE Metals index is still in a bear market, despite rising 37% from its Dec ‘11 low and a brief foray above the 200 day EMA. The blue down trend line continues to rule the chart. One can be a contrarian, but be very selective in choosing stocks.

BSE Oil & Gas Index

The BSE Oil & Gas index is trying desperately to stay above the 200 day EMA, but has still not broken its down trend line. Interference by the government has almost ruined this sector. Avoid the oil PSUs. The gas PSUs are in better shape.

BSE Power Index

A spectacular rally in the beaten down BSE Power index has almost propelled it into a bull market. The index is trading above its 200 day EMA and has pulled back to the blue down trend line after climbing past it. The ‘golden cross’ is still awaited. Rumours of likely sops in the forthcoming budget has fuelled the rally. Unless coal supply is ensured, the power sector may continue to face headwinds. Avoid.

BSE Realty Index

The BSE Realty index had been hammered to a pulp by the bears, but is trying to make a strong recovery. The chart shows an upward break out from a bullish inverse head-and-shoulders reversal pattern. The ‘head’ of the pattern is itself a mini inverse head-and-shoulders pattern. Note that the minimum upward target from the inverse head-and-shoulders pattern has been met.

After climbing above the 200 day EMA and the support-resistance level of 1900, the index is pulling back towards both. If you want to invest in the sector, you may want to read this recent post.

No comments:

Post a Comment