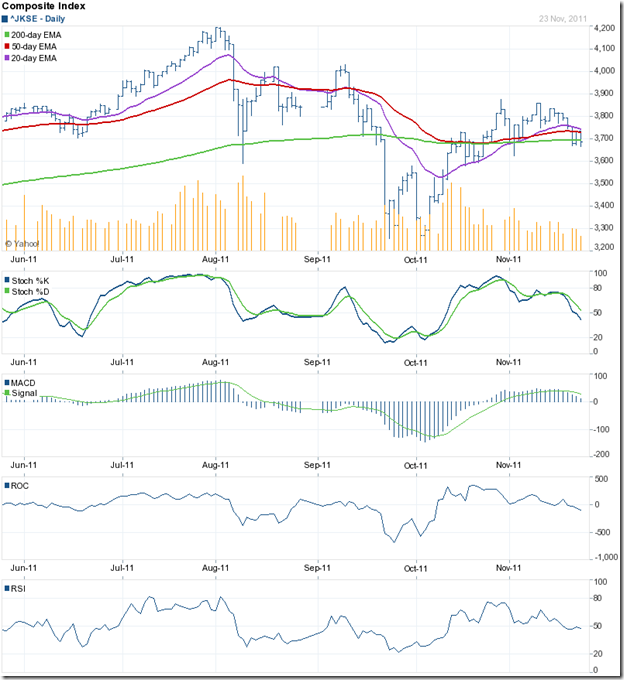

Jakarta Composite Index Chart

The Jakarta Composite index chart continues its struggles to shake off the bears. In today’s trade (not shown in above chart), the index tested its Nov ‘11 intra-day low of 3624 and closed at 3637 – the lowest close in Nov ‘11. The index has closed below the 200 day EMA on a weekly basis, and is forming a bearish pattern of lower-tops-and-lower-bottoms.

Note that the RSI, which has slipped below the 50% level, formed a head-and-shoulders reversal pattern (the possibility was mentioned two weeks back). The slow stochastic has also fallen below its 50% level. The ROC has entered the negative zone. The MACD, which is dropping below its falling signal line, is about to turn negative.

The bears are trying to regain control. If the index drops below 3550, it may go down to test the Oct ‘11 intra-day low of 3256.

Korea KOSPI Index Chart

The KOSPI index chart pattern had dropped below all three EMAs two weeks back with a big downward gap. The bulls made a brave attempt at another rally, and managed to close the gap but failed to reach the 200 day EMA. On Wed. Nov 16 ‘11, the index formed a ‘reversal day’ pattern on strong volumes and dropped below all three EMAs once again.

This time, there was no respite from the bear selling. The 20 day EMA has crossed below the 50 day EMA, and the index is trading well below all three EMAs. All four technical indicators have turned bearish. Note that both the ROC and RSI formed head-and-shoulders reversal patterns. The slow stochastic is inside its oversold zone. The MACD has entered the negative zone below its signal line.

There is hardly any doubt that the bears are back in control.

Taiwan TSEC Index Chart

The Taiwan TSEC index chart pattern continues to be the weakest among the three Asian indices. Two weeks back, I had mentioned the possibility of the index testing its Sep ‘11 low of 6877. In today’s trade (not shown in the chart above), the TSEC dropped all the way to 6751 – a 2 years low.

The technical indicators are very bearish. The slow stochastic is inside its oversold zone. The MACD is below its signal line and falling deeper into negative territory. The ROC is deep inside negative territory. The RSI is hovering above its oversold zone. The index is trading well below all three EMAs.

The index is under complete bear control. Any counter-trend rallies or upward bounces are likely to provide more selling opportunities.

Bottomline? The Jakarta Composite index chart is in a long-term bull market, as it is trading well above its Jan ‘08 bull market top - but is struggling to shake off a bear attack. The Korea KOSPI index rose above its previous bull market top, but is now in a bear market. The Taiwan TSEC index failed to get past its previous bull market top, and is in a bear market. Stay on the sidelines. Lower levels are likely.

Related Post

No comments:

Post a Comment