S&P 500 Index Chart

Last week, I had mentioned the possibility of the S&P 500 index dropping below the 50 day EMA, and a probable test of support from the 200 day EMA. On Mon. Jul 18 ‘11, the index did drop below the 50 day EMA, but staged a remarkable turnaround during the rest of the week – thanks to good corporate earnings and news of the Greek bailout plan. The S&P 500 had a weekly gain of 2.2%.

That was the good news. The bad news is that the index failed to reach a new high, and remains in a sideways trading range with an upward bias. As long as the index keeps trading above a rising 200 day EMA, the bulls need not worry.

The technical indicators are looking bullish. The slow stochastic is rising above its 50% level. The MACD is above the signal line, and moving up in positive territory. The RSI isn’t looking that convincing, treading water just above the 50% level.

The US economy is in a listless state – neither cracking, nor really growing. New unemployment claims rose by 10,000 to 418,000 – the 15th straight week above the 400,000 mark. Thanks to the noise generated by the political brinkmanship playing out in DC over raising the debt limit, consumer sentiment is plunging.

No need to place fresh bets, just hold on.

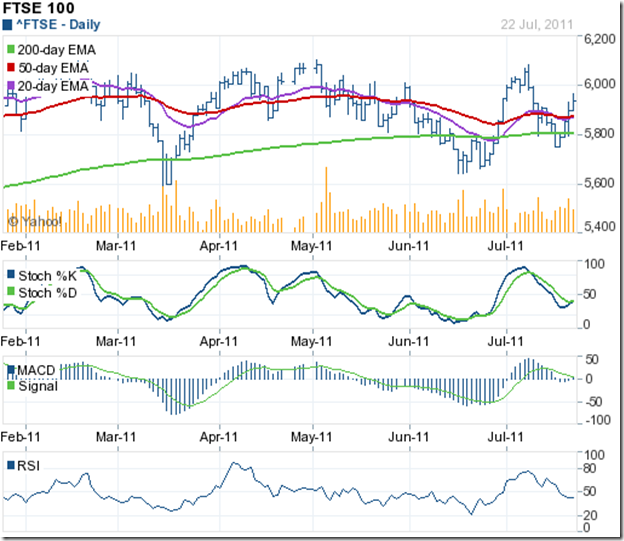

FTSE 100 Index Chart

In last week’s analysis, the technical indicators had hinted at another drop below the 200 day EMA for the FTSE 100 index. Sure enough, the index spent a couple of days below its long-term moving average before a rally riding on the Greek bailout news took the FTSE 100 above all its three EMAs.

The index managed a 1.5% higher weekly close, but failed to regain the 6000 level. Friday’s (Jul 22 ‘11) low volumes indicate that the bullish fervour may be fading. The negative divergences in the technical indicators aren’t holding out much hopes for a continuation of the rally either.

The slow stochastic and RSI have both slipped below their 50% levels. The MACD just managed to turn positive after spending three days in the negative zone. The FTSE 100 is in a sideways trading range for more than 6 months now, and the bull market is showing signs of stalling.

Bottomline? The chart patterns of S&P 500 and FTSE 100 indices are back in bull market territory, but the bulls are beginning to look tired. Faltering economies in the USA and the Eurozone has sent gold prices soaring again. Remain invested, but no fresh buying is recommended at this stage.

No comments:

Post a Comment