S&P 500 Index Chart

Last week, weakness in the technical indicators had indicated a possible drop towards the rising 50 day EMA. A bearish rounding top formation saw the S&P 500 index chart slip down to test support from the 50 day EMA, only to bounce up and close the week just below the 1320 level. Is the correction over, or can the index drop some more?

Two of the three technical indicators are suggesting that a further correction or consolidation is likely. The MACD is still positive but has fallen below its signal line. The slow stochastic has dropped below its 50% level. The RSI bounced up from its 50% level, and may prevent a deep correction.

Macro-economic news continues to be unexciting. New unemployment claims rose above the 400000 mark. University of Michigan Consumer Sentiment index rose marginally, but remains almost 20% below its average value. High oil prices and rising inflation remain concerns. Two doses of QE have boosted the S&P 500 chart, but the time of reckoning may be near.

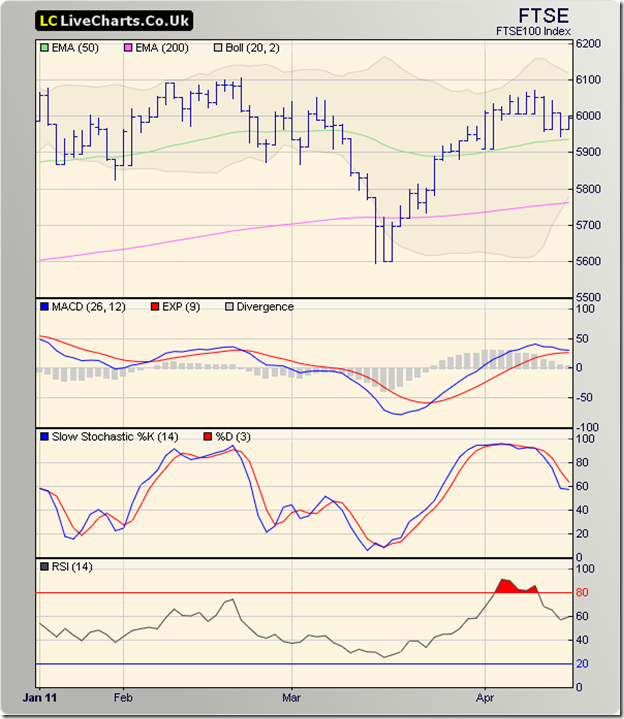

FTSE 100 Index Chart

The technical indicators were looking overbought last week, and I had mentioned the possibility of a correction in the FTSE 100 chart. The index made a bearish rounding top pattern, followed by an intra-day test of support from the 50 day EMA on Thurs. Apr 14 ‘11. The index bounced up, but closed a bit below the 6000 level – a 1% loss on a weekly basis.

The technical indicators are showing some weakness. The MACD is positive, but has changed directions and about to touch its signal line. The slow stochastic dropped from its overbought zone, but is above the 50% level. Likewise for the RSI. The correction may not be over yet.

Bottomline? The chart patterns of the S&P 500 and FTSE 100 indices are undergoing corrections. The failure of both indices to move above their Feb ‘11 tops leaves the door open for a bearish double-top reversal pattern. The double-tops will get confirmed only if the indices fall below their Mar ‘11 lows. The possibility should induce caution. Taking some profits off the table, and maintaining stop-losses will be the prudent option.

No comments:

Post a Comment