Another trading week, shortened by a holiday, has gone by. Both the Sensex and Nifty indices continued their consolidation within the trading ranges marked in last week’s chart patterns. The bulls and bears have been unable to resolve their differences. Or have they?

I have been analysing the daily bar chart patterns of both indices. This week, I decided to take a longer term view. Weekly closing charts of the entire bull market since the closing lows touched in Mar ‘09 are analysed below. They throw up some interesting findings.

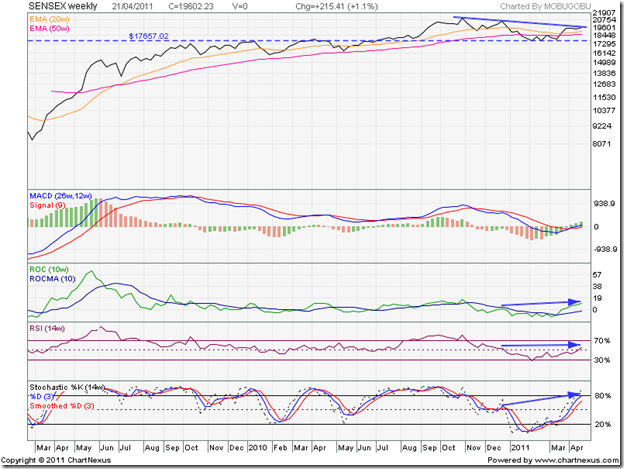

BSE Sensex Index Chart

The down trend line drawn through the closing tops of Nov 5 ‘10 (21005) and Dec 31 ‘10 (20509) was touched by Thursday’s (Apr 21 ‘11) closing level of 19602. The down trend appears to be intact, but may not be for long. The technical signs are bullish, and I will take them up one by one.

The long-term support/resistance level of 17600 – which corresponds to the closing top of Jan ‘10 - was briefly, but not convincingly, breached in Mar and Apr ‘10. A convincing break out (i.e. past the 3% ‘whipsaw’ leeway) occurred in Jul ‘10, after which 17600 acted as a support level during the recent correction.

The 20 week and 50 week EMAs came close to touching each other during the recent correction. Both have started rising and moving away from one another, and the index is trading above them. The long-term bull market is very much alive, though the Sensex spent 8 straight weeks below the 50 week EMA (which is considered equivalent to the 200 day EMA on daily charts) and threatened to fall into a bear market.

The MACD has crossed above its signal line into positive territory. The ROC is positive, and rising above its 10 week MA. The RSI has moved above the 50% level for the first time in 2011. The slow stochastic is about to enter its overbought zone after almost 6 months. More importantly, three of the four indicators are showing positive divergences by reaching higher tops (marked by blue arrows).

The bulls are all set to regain control of the Sensex.

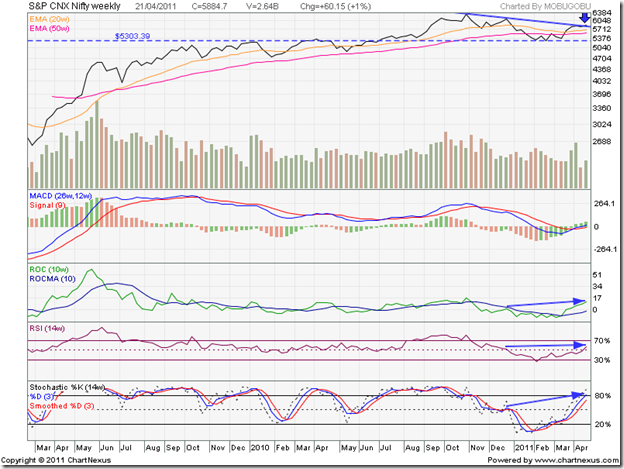

Nifty 50 Index Chart

The Nifty 50 chart is looking even more bullish. This week’s closing level breached the down trend line (barely visible on the top right corner of the chart, and marked with a down-arrow) – though the breach is not convincing yet. Volumes were not significantly higher. Some more consolidation may be required before a convincing break out occurs. The technical indicators are supporting the bulls.

Despite all the global and local bad news, the Nifty hasn’t breached the long-term support/resistance level of 5300. On a closing basis, the index corrected just about 1000 points (16%), and remains in a long-term bull market. What we have witnessed over the past 6 months appears to be just a bull market correction.

Q4 results declared so far have been good. Infosys and Reliance results were good, but below market expectations. TCS, HCL Tech, Yes Bank results were very good and above expectations. Food inflation is still a concern, and the market appears to have discounted a 25 basis points interest rate hike by the RBI next month.

Bottomline? The BSE Sensex and Nifty 50 index chart patterns are showing signs of emerging from 6 months of correction. Valuations look fair, which means aggressive buying should be avoided. This may be a good time to churn your portfolios based on Q4 results – get rid of the weak performers and switch to better stocks. Long-term investors can stay invested using the long-term support/resistance levels marked on the charts as stop-loss levels.

No comments:

Post a Comment