Last week, I had mentioned that the post-budget relief rally had helped the bulls to keep the ‘death cross’ at bay. But the inevitable happened. High oil prices and inflation concerns led to FII selling, and the 50 day EMA slipped below the 200 day EMA on the Sensex and Nifty charts. The devastating earthquake and tsunami in Japan added to the selling pressure in an already weak market.

BSE Sensex Index Chart

What is heartening from a bullish point of view is that despite negative news flows and bearish investor sentiments, the Sensex hasn’t really cracked. It completed six weeks within the consolidation range between 17300 and 18700, and is likely to spend some more time within the range. Will the support from the 17300 level hold?

As per the theory of consolidation patterns, the answer is ‘No’. Consolidation patterns tend to be continuation patterns. In other words, the previous trend – which was down - will continue after the consolidation is over. Note that last week’s brief up move found resistance from the falling 50 day EMA. Both the 50 day and 200 day EMAs have dropped within the trading range and may thwart any up moves.

The technical indicators are still giving mixed signals. The MACD is above the signal line, but remains in negative territory and has stopped rising. The ROC has moved above its 10 day MA into the positive zone. The RSI has dropped to its 50% level. The slow stochastic has started retreating after reaching its overbought region.

Nothing is sacrosanct in technical analysis. So watch the 17300 level closely. A high volume upward bounce may just get the buying support to break above the consolidation range. A more likely outcome is a break below 17300 and a test of the May ‘10 low of 16000. If the RBI hikes interest rates next week, the bears may use that as a trigger to sell.

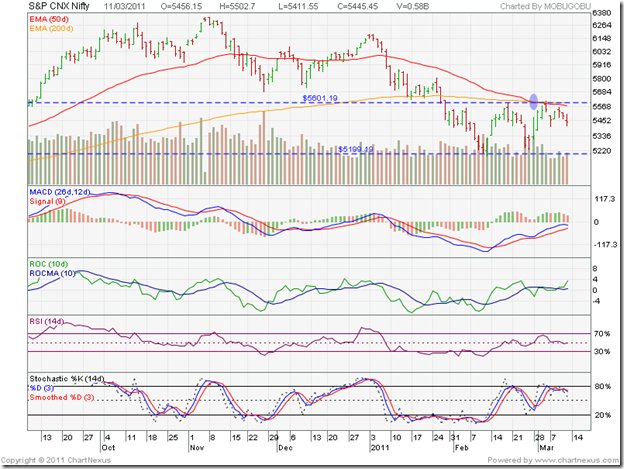

NSE Nifty 50 Index Chart

The Nifty traded within the range of 5200 and 5600 for the sixth week in a row. Note that volumes have begun to recede, and that means the index is likely to drift down towards the lower edge of the trading range. The technical indicators are not providing any clear direction, so the consolidation within the trading range may continue.

Industrial production figures were an improvement. Inflation has also started to moderate, thanks to the base effect. But such ‘good’ news is being ignored by the market, which is a bearish sign. The rising cost of oil imports with no increase in retail prices of petrol, diesel or kerosene means an additional subsidy burden. By postponing the FPOs of ONGC, SAIL and others in the pipeline, the government is worsening a bad situation.

The release of the biggest Income Tax defaulter and money launderer on bail is ridiculous. It points to his high level connections that may have been revealed if he was kept behind bars and interrogated. India is becoming a laughing stock in front of the international community, and tomtomming our GDP growth isn’t going to bring in FDI and FII money that we badly need to build our infrastructure and sustain growth.

Bottomline? The chart patterns of the BSE Sensex and Nifty 50 indices are still consolidating within a trading range. Investor patience gets sorely tested by such periods of consolidation. The medium and long-term trends are down, and the ‘death cross’ has confirmed a bear market. Long-term investors should maintain a strict stop-loss at the lower edge of the trading range. Short-term players can trade the range.

No comments:

Post a Comment