BSE Sensex Index Chart

Last week’s upward bounce in the chart pattern of the BSE Sensex index had turned the technical indicators mildly bullish, but the spate of scams and corruption incidents had changed the market sentiments towards bearishness. FII selling due to year-end profit booking considerations were not helping the bull cause either.

It was no great surprise when the index briefly moved above the 20200 mark intra-day (but short of the 20300 mark mentioned), only to drop towards the support from the entangled 20 day and 50 day EMAs on Mon. Dec 6 ‘10. The next leg of the down trend began in earnest from Tuesday.

By Thu. Dec 9 ‘10, the index had fallen sharply to close below the 100 day EMA – the second time it had done so in 2 weeks. Today’s partial recovery took the Sensex to a close above the 100 day EMA. But the index is now trading within a downward sloping channel, and the technical indicators are signalling a continuation of the correction.

The MACD is in negative territory and has slipped below its signal line. The ROC has bounced back into the positive zone after receiving support from its 10 day MA. Both the RSI and slow stochastic are below their 50% levels. Note that the 200 day EMA is still rising and the index is trading above it. So, there is no reason to panic.

The expected good advance tax collections next week may provide some hope to the bulls. But the downtrend will remain in force till the index breaks out upwards.

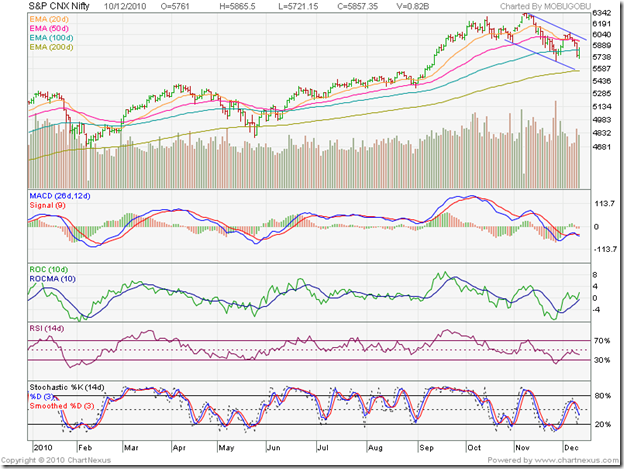

NSE Nifty 50 Index Chart

A couple of things had made me sceptical about the upward bounce in the chart pattern of the Nifty 50 index last week. The bounce was on declining volumes and the technical indicators were displaying negative divergences.

The volume data is still a concern. This week’s correction has been on increasing volumes. Thursday’s down-day volume was greater than today’s up-day volume. In a bull market, up-day volumes are usually stronger than those on down-days.

The technical indicators, except the ROC, are bearish. More importantly, the Nifty is now trading within a downward sloping channel. A test of support from the 200 day EMA is quite likely. If the support breaks, there is stronger support in the 5400-5500 zone.

Bottomline? Both the BSE Sensex and Nifty 50 chart patterns are in intermediate down trends. Investors can book partial profits or just wait this correction out. Fundamentally strong stocks can be bought if the valuations are appealing. The market sentiment will turn bullish only after a high-volume break out above the downward sloping channels.

2 comments:

on you sep 30 blog post you suggested that the stock market is heading to 22000 with a likely 10% correction midway. Do you see good indicators that this may be that correction leading to sensex @ 18.5K?

A 10% correction from the Nov 5 '10 intra-day high of 21109 to the Nov 26 '10 intra-day low of 18955 has already happened.

The Sensex is still trading within a downward channel. Till it breaks out upward, a test of the 18500 level is a distinct possibility.

Post a Comment