Shanghai Composite index chart

The bull rally in the Shanghai Composite index chart pattern hit the pause button last week. It received good support from the intertwined 20 day and 50 day EMAs and closed above the 2600 level – but lost 50 points on a weekly basis.

More importantly, it has remained below the falling 200 day EMA. That means, the long-term bear market still reigns. There are two possibilities about the future direction of the Shanghai Composite. It can use the strong support from the entangled 20 day and 50 day EMAs, and make an attempt to cross above the 200 day EMA.

Alternatively, it can drop down further after making a small double-top pattern. The technical indicators are hinting at the latter. The slow stochastic has dropped from the overbought zone. The MACD is still positive and above the signal line, but has fallen a bit. The ROC is resting on the ‘0’ line. The RSI is moving down towards the 50% level.

The property bubble has burst in China, and that may have a cascading effect on the rest of the economy. Rows upon rows of unoccupied apartment towers in major cities may not be very conducive to a resumption of the bull market.

Hang Seng index chart

It was a case of ‘so near and yet so far’ for the Hang Seng index last week. After moving past the 21800 level on low volumes, the index failed to make further headway. Rallies on decreasing volumes tend to fizzle out.

Volumes started to rise as the Hang Seng slipped and closed more than 600 points lower on a weekly basis. The 50 day EMA couldn’t move above the 200 day EMA and the 20 day EMA has stopped rising.

The technical indicators have turned weak. The slow stochastic has dropped from the overbought zone. The MACD is positive but falling and clinging on to the signal line. The ROC is at the ‘0’ level. The RSI has dropped sharply from the overbought zone.

Bulls will point out that the index has received support from the 20 day EMA and a further fall may get support from the 200 day EMA. The rising volumes during the fall is a sign of distribution.

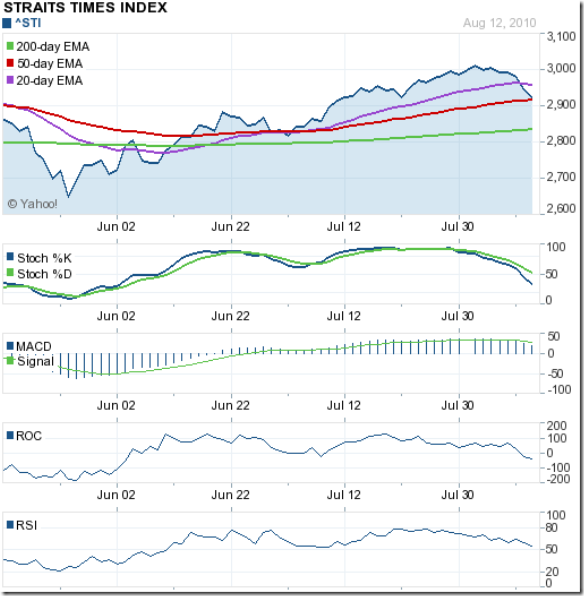

Straits Times (Singapore) index chart

In the beginning of Jul ‘10, the Singapore Straits Times index chart had fallen below the twin support of the 20 day and 50 day EMAs, and I had expected it to drop further to the 200 day EMA.

It proved to be a temporary lull before the bull market resumed. The index charged up to test the Apr ‘10 top of 3038 and reached a slightly higher top at 3043 on Aug 3 ‘10. The double-top halted the rally.

The index fell below the 20 day EMA and stopped at the 50 day EMA, losing more than 100 points (3.4%) from the top. Both the 50 day and 200 day EMAs are still rising, the sign of a long-term bull market.

The technical indicators have weakened a lot. That means the short-term bearishness may last a little longer.The slow stochastic has dropped below the 50% level. The MACD is positive but has fallen below the signal line. The ROC has entered negative territory. The RSI is just above the 50% level, but sliding. All four technical indicators failed to make new highs when the index touched its Aug 3 ‘10 top.

Bottomline? The Shanghai Composite index chart is still in a bear market. The bull rallies in the Hang Seng and Straits Times index charts have hit road blocks. All three indices are at important support levels, but showing short-term weakness. The correction/consolidation may continue next week.

No comments:

Post a Comment