FTSE 100 Index Chart

The FTSE 100 index chart pattern behaved like a textbook example in technical analysis. In last week’s analysis, I had mentioned that the rising volumes while the index dipped was a sign of distribution. Negative divergences in the RSI and MFI were also worrying signs for the bulls.

The index spurted up on Monday (Aug 9 ‘10) in a desperate effort to shake off the bears and tried to test the May 13 ‘10 intra-day and closing highs - but fell short by 20 odd points. The weak volumes didn’t help the bull cause.

The FTSE 100 quickly dropped down on the next two days on rising volumes, and received expected support from the entwined 50 day and 200 day EMAs. The small upward bounce on the last two days of the week could not move the index above the 5300 level or the 20 day EMA. The FTSE 100 lost 1% on a weekly basis.

The technical indicators are looking bearish. The slow stochastic has fallen to the 50% level. The MACD is positive, but has slipped below the signal line. The RSI and MFI are both below their 50% levels.

The bullish pattern of higher tops and bottoms has been broken. The index may try a pullback to the trend line connecting the recent (higher) bottoms. Without volume support, any up moves will be short-lived, and there is every possibility of the FTSE 100 dropping back into bear country (i.e. below the 200 day EMA).

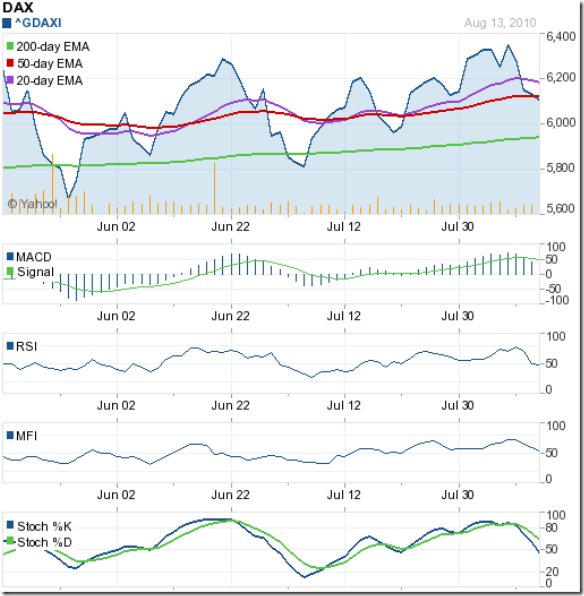

DAX Index Chart

The DAX index chart pattern made a new closing high of 6352 on Mon. Aug 9 ‘10, but low volumes failed to move the index past previous Friday’s reversal day top of 6387. Volumes picked up during the rest of the week as the index dropped below the 20 day EMA, and closed the week below the 50 day EMA. The DAX lost 2.4% on a weekly basis.

The up trend line connecting the recent (higher) bottoms in Jul and Aug ‘10 have been broken, and a pullback attempt by the bulls can be expected. But the technical indicators have turned weak, which could lead to a drop towards the 6000 level and the rising 200 day EMA.

The slow stochastic has slipped below the 50% level. Likewise for the RSI. The MFI is barely above the 50% level. The MACD is positive, but below the signal line.

The German economy is in better shape than most of its European neighbours, and there is no immediate threat of the DAX index moving into a bear market.

CAC 40 Index Chart

The CAC 40 index chart could not remain above the 200 day EMA for long. In last week’s analysis I had observed a negative divergence in the MFI, and the RSI had risen sharply to the overbought zone. A consolidation or correction was, therefore, expected.

The index fell quickly on rising volumes and closed below all three EMAs – re-entering the bear market, and losing 2.8% on a weekly basis. The 20 day EMA is above the 50 day EMA, but all three EMAs are heading down.

The technical indicators have turned bearish. The slow stochastic and the MFI are below their 50% levels. The RSI is at its 50% level. The MACD is positive but below the signal line.

Bottomline? The chart patterns of the European indices are showing the after-effects of a strong bear attack, following five weeks of bull dominance. On the longer-term charts, the FTSE 100 and CAC 40 are looking weak, and any pullbacks can be used to book profits. The DAX chart is looking bullish. Any dips can be used to add.

No comments:

Post a Comment