The Dow Jones (DJIA) index chart pattern started hesitating as it approached the technically significant resistance level of 11100 mentioned in last week's analysis.

In a holiday-truncated week, the Dow made a high of 10983 on Thursday - a tad short of its previous high of 10985 made on Mar 25 '10 - and closed at 10927, 77 points higher on a weekly basis.

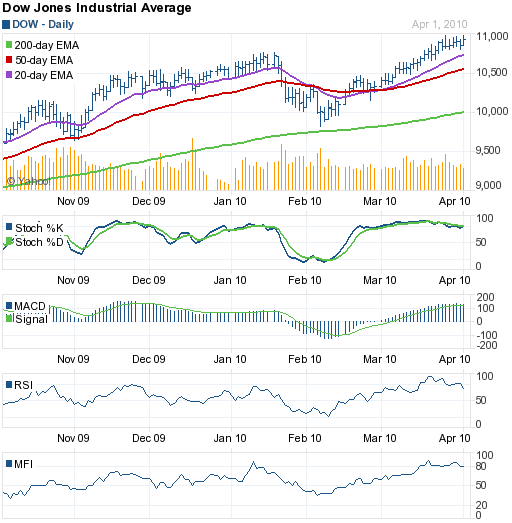

A look at the 6 months bar chart pattern of the Dow Jones (DJIA) index shows the beginning of a bullish ascending triangle formation from which a likely upward break out can take the index to the 11500 level:-

The bears will try and grasp at the last straw - the 11100 level - and put up some sort of a fight. But it doesn't look like they have much ammunition left in their armoury.

All three EMAs are moving up with the index above them. The volumes have been pretty decent. The slow stochastic is at the edge of the overbought zone. So is the MFI. The MACD has flattened, but remains positive and above the signal line.

The RSI is showing negative divergence, and is the only concern for bulls. Note that just before the Dow's previous correction in Jan '10, the RSI, MFI and the slow stochastic almost simultaneously dropped from their overbought zones. No such 'confirmation' of any weakness is visible now. But forewarned is forearmed.

On the employment front, nonfarm payrolls increased by 162000 in March '10, the biggest monthly increase in 3 years. Is that a good reason for unbridled bullishness in the stock market? Read this article for a different perspective.

Bottomline? The Dow Jones (DJIA) index chart pattern hasn't yet cleared the technical hurdle of 11100. But it seems just a matter of time before it does so. Stay invested, maintain trailing stop-losses and start buying after a convincing move past the 11100 level.

No comments:

Post a Comment