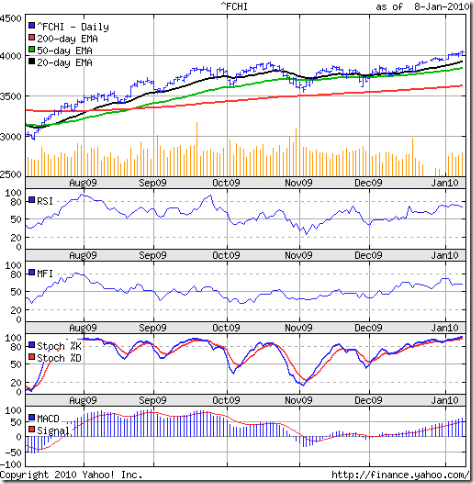

FTSE 100 index chart

Last week, I had mentioned that the FTSE 100 index chart may face resistance at the 61.8% Fibonacci retracement level of 5500. On the first day of the week (Jan 4 '10) the index closed exactly at the 5500 level. It proceeded to close marginally above 5500 for the next four days on good volumes. A new high of 5552 was made on Jan 7 '10.

The break above the 5500 level isn't convincing as yet, in spite of 4 straight closes above it. Why? Because of the 3% 'whipsaw' lee-way followed in technical analysis. That means 5665 needs to be crossed before the bulls can take complete control.

It should be a question of when, not if. All three EMAs are moving up and the index is above them. For a change, the up move is receiving volume support. The technical indicators are also bullish.

The RSI is headed up towards the overbought zone. The MFI bounced off nicely from the 50% level. The slow stochastic is well-entrenched in the overbought zone. The MACD is moving up in positive zone and is above the signal line.

Bears can only hope that the negative divergences in the technical indicators can play spoilsport to the bull rally.

DAX index chart

The DAX index chart pattern made a new high of 6058 on Jan 5 '10 and closed all 5 days of the week above the 6000 level on decent volumes. The index is above the three EMAs, which are moving up. The bulls are looking to extend their dominance in the new year.

The technical indicators are not quite as bullish as those of the FTSE 100. The slow stochastic is well inside the overbought zone. The MFI has bounced off the 50% level. But the RSI has dipped after touching the overbought zone. The MACD is in positive territory and above the signal line, but has stopped moving up.

CAC 40 index chart

The CAC 40 index chart also looks bullish, with all three EMAs moving up and away. The index made a new high of 4051 on Jan 8 '10 and closed above the 4000 level an all 5 days of the week. Volumes have picked up in the new year.

The technical indicators are looking reasonably bullish. The RSI has dipped a little after coming close to the overbought zone. The MFI is moving sideways above the 50% level. The slow stochastic is comfortably inside the overbought zone. The MACD is moving up in positive territory and is above the signal line.

Bottomline? The bulls continue to hold sway in the European index charts. This rally has continued for 10 months now, so maintain trailing stop-losses and stay invested.

No comments:

Post a Comment