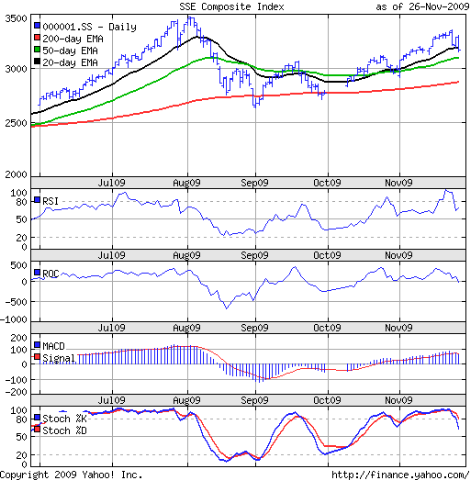

Shanghai Composite index chart

Another clear instance of how relying totally on technical analysis can be hazardous to your wealth! Last week, the technical indicators of the Shanghai Composite index chart was looking very bullish, and the only question was when it would go past the previous high of 3478.

Out of nowhere, the bears attacked viciously, as a 'reversal day' pattern on Tue, Nov 24 '09 brought the renewed bull rally to a quick halt. An attempt at a recovery the next day proved short-lived. The bears used the news of the Dubai loan default to take the index below the 20 day EMA. The week ended with the index dropping down to the 50 day EMA.

The technical indicators turned around quickly from strongly bullish to bearish. The RSI dropped steeply from the overbought zone. So did the slow stochastic. The ROC has slipped into the negative zone. The MACD has started to fall and dropped below the signal line.

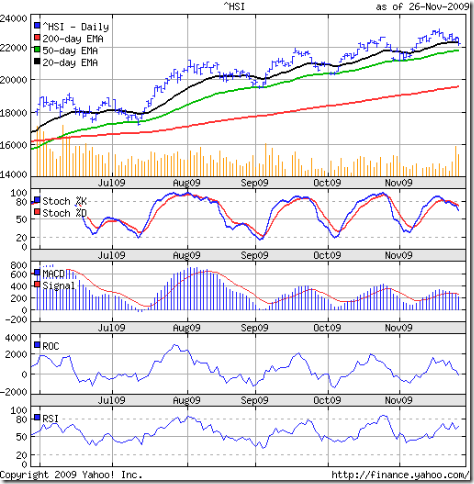

Hang Seng index chart

When the big brother sneezes, the younger brother and cousin catch a cold - or so it seems from the chart pattern of the Hang Seng index. Actually, the Hong Kong index started to correct in the previous week after making a new high of 23100 on Nov 18 '09.

The fall on Thur, Nov 26 '09 had taken the index below the 20 day EMA and today's near 5% drop meant the index closed below the 50 day EMA for the first time since July '09. Will the Hang Seng be able to bounce up from the support of the 50 day EMA, as it has done several times during this bull rally?

The technical indicators don't seem to suggest that. The slow stochastic is moving down towards the 50% level. The MACD is falling and has gone below the signal line. The ROC has dropped into the negative zone. The RSI showed negative divergence by failing to make a new high and is moving sideways above the 50% level.

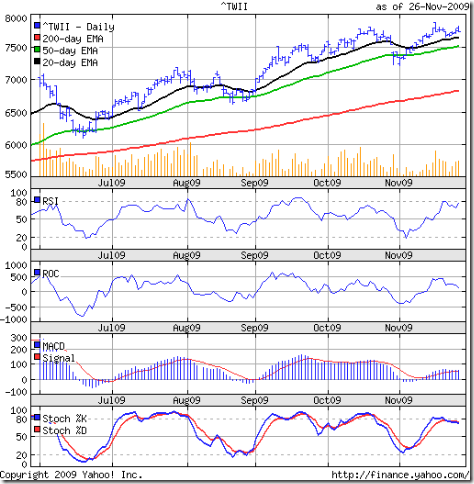

Taiwan (TSEC) index chart

The Taiwan (TSEC) index was looking quite bullish as it recovered from a drop below the 50 day EMA to make a new high of 7875 on Nov 17 '09. A brief correction down to the 20 day EMA was followed by another up move. Today's near 250 points (3.2%) drop once again forced a close below the 50 day EMA.

As long as the index remains well above the rising 200 day EMA, there is no threat to the bull market. The technical indicators are looking less bearish than the two mainland indices.

The RSI is just below the overbought zone. The ROC is falling but remains in the positive zone. The slow stochastic has fallen less sharply from the overbought zone. The MACD is positive and above the signal line, but note the negative divergence as it failed to make a new high.

Bottomline? The Asian indices suffered from FII selling. I had hinted about the possibility last week. The Dubai loan default news was used as a trigger for the selling, but not entirely without reason. HSBC bank is reported to have a big exposure in Dubai. All three indices are near their 50 day EMAs. An upward bounce could be on the cards next week. Adopt a wait-and-watch policy.

No comments:

Post a Comment