During last week's discussion of the stock chart patterns of European markets, it was observed that the liquidity driven rally was likely to continue a while longer. The technical indicators were pointing to the bulls regaining control after a brief correction.

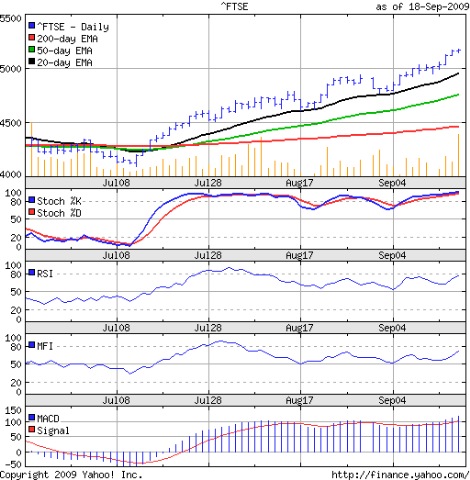

FTSE 100 index chart

The bull party continued with gusto - the week ending on a new high of 5173 on significantly higher volume. All three EMAs are moving merrily upwards with the FTSE. (The marginal increase of 9 points over the closing level of Thu, Sep 17 '09 on 50% higher volume could be an indication of buying exhaustion.)

The slow stochastic is well within the overbought zone. The RSI and MFI are swinging up wards and about to enter their overbought zones. The MACD has made a new high as well. The bulls are firmly in control.

The rally seems to me like the tail is wagging the dog. A surfeit of liquidity - created in a coordinated manner by the G20 countries to bolster their faltering economies - is trying to create the optimism that may lead to consumer confidence and the good old days of borrowing money to spend.

It is not working. The banks are boosting their bottom lines through their trading desks. Traditional lending activities continue to lag. The economy remains far away from a recovery.

DAX index chart

The DAX joined the FTSE bull party - but look what happened on Fri, Sep 18 '09. The volume more than doubled from Thu, Sep 17 '09, and the index made a higher high but a lower close. A 'reversal day', indicating buying exhaustion.

The three EMAs continue their up move with the index, indicating bullishness. The slow stochastic is in the overbought zone, but the %K line has moved down to touch the %D. Both the RSI and MFI are above their 50% levels, but are dropping. The MACD is positive and above its signal line, but is showing negative divergence.

The DAX technical indicators are nowhere near as bullish as those of the FTSE.

CAC 40 index chart

The CAC also joined the FTSE bull party, but failed to keep up - ending the week with a 'reversal day' (higher high, lower close on significantly higher volume).

The flood of liquidity has been negating almost all bearish technical signals. Normally, a reversal day should lead to a correction. But note the bar of last Thu, Sep 10 '09. That was also a reversal day, but the index ignored it. This time around, the higher volume may do the trick.

The technical indicators are looking like carbon copies of the DAX indicators. Except the MACD, where the negative divergence is not as pronounced.

Bottomline? The stock index chart patterns of the European markets are showing buying exhaustion, which could lead to a correction. Part profit booking is advised. Better entry points may become available.

No comments:

Post a Comment