Dow Jones (DJIA) index chart

During the previous week's analysis of the Dow Jones (DJIA) index chart pattern, I had expressed my reservations about the continuation of the bull rally because of two things - the lack of volumes and the 'rising wedge' bearish pattern.

The bulls emerged rejuvenated after the long weekend and the index made higher tops and bottoms every single day of the truncated week of trading. But look what happened on Fri, Sep 11 '09 - a higher high but a lower close. A bearish 'reversal day'.

The 3 months bar chart pattern of the Dow Jones (DJIA) index shows the effort by the bulls to shake off the poor fundamentals and technicals of the market:-

All three EMAs are moving up with the index, which means that the bulls are still in control. The bears appear to be in need of a confidence booster to launch a proper attack. The short squeeze in Jul '09 is still fresh in their minds.

The low volumes remain a concern. The technical indicators are not supporting the gung-ho bullishness in the Dow. The RSI turned flat after rising above the 50% level. The MFI remains above the 50% level but is heading down. The slow stochastic stopped short of entering the overbought zone. The MACD rose a bit but failed to move above its falling signal line.

Note the negative divergences in all the indicators, which failed to make new highs with the index. That doesn't mean you should short this market. Not yet. Wait for it to go below the low of 9223 made on Sep 2, '09.

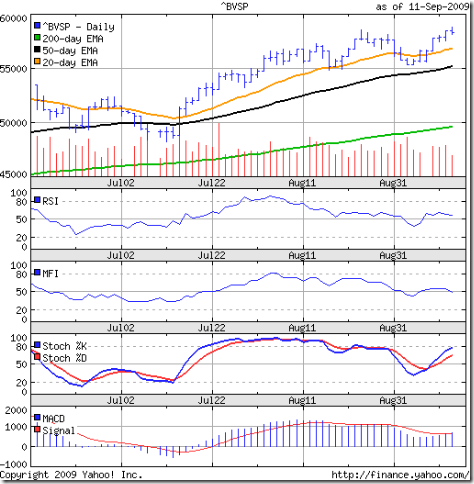

Bovespa (Brazil) index chart

I had looked at the Bovespa (Brazil) index chart pattern nearly two months ago, when it was trying to shrug off a correction. The subsequent up move was strong, as the bears were trapped badly.

The 3 months bar chart pattern of the Bovespa (Brazil) index is now following the moves of the Dow closely:-

Almost a lock-step move with the Dow last week - moving above the 20 day EMA and making higher tops and bottoms through the week, ending with a bearish 'reversal day'.

There are two significant differences between the Dow and Bovespa. A much wider gap between the 50 day and 200 day EMAs in the Bovespa chart, indicating a much stronger bull rally. Volumes are also much lower but less volatile.

The RSI is just above the 50% level. The MFI has slipped below the 50% level. The slow stochastic has also stopped short of entering the overbought zone. The MACD has moved a bit above its flattening signal line.

Bottomline? Both the Dow Jones (DJIA) and Bovespa (Brazil) index chart patterns are showing a bit of fatigue after the hectic climb last week. A correction this week would help the bull rally to get stronger. (At the time of writing this post, both indices seem to be in correction mode.)

No comments:

Post a Comment