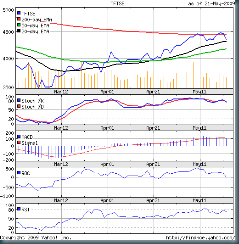

The FTSE 100 index chart pattern tried to defy gravity and made another effort to cross its 200 day EMA. In fact it managed to spend two days just above it.

The effort seemed to take the wind out of its sails, and it dropped down again to seek support from its 20 day EMA. In the process, the index has made a double-top pattern, which indicates bearishness, and may terminate the recent rally.

A look at the 3 months closing chart pattern of the FTSE 100 index will show that the bearishness is being confirmed by the technical indicators as well:-

(Please right-click on the image above; open it in a new tab or window for a better view.)

The slow stochastic has slipped down from the overbought zone. Both the ROC and RSI made lower tops while the FTSE was trying to make a higher top. This negative divergence was followed by both indicators beginning their down moves.

The MACD is touching its signal line and both are moving downwards. The volume is reducing with the down move of the FTSE, as it is supposed to do.

Since Apr '09, the index has bounced up every time it has touched or dropped near its short-term average. So another bounce up may not be surprising.

Bottomline? Watch the 20 day EMA closely. Should the FTSE 100 index chart pattern start to weaken and fall below the short-term average, a stronger down move may follow.

No comments:

Post a Comment