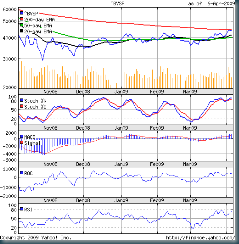

Brazil's Bovespa chart pattern looks quite different from all the index chart patterns discussed so far. The only similarities are the Mar '09 rally, and the stock index being below the 200 day EMA, indicating a long term bear market.

The striking differences in the Bovespa 6 months closing chart pattern can be seen below:-

(Please right-click on the image above and open it in a new tab or window for a better view.)

Most global indices made a 52 week low in Mar '09. Bovespa's Mar '09 low is almost 30% above its 52 week low made in Oct '08.

In Jan '09, the 20 day EMA moved up from below to touch the 50 day EMA. Thereafter, the 20 day EMA and 50 day EMA have been in a tight embrace while the Bovespa consolidated in a rectangular sideways pattern between the 38000 and 42000 levels - well above the Oct '08 52 week low and the higher Nov '08 low.

The global rally that started in Mar '09 culminated with the Bovespa moving above the rectangular sideways pattern on April 2, '09. But the 200 day EMA provided strong resistance. The volume has also fallen off the past couple of days.

The technical indicators - slow stochastics in the over bought zone, MACD, ROC, RSI in positve zones - are confirming the recent bullishness.

Bottomline? The overall chart pattern of the Bovespa is looking a lot stronger than the Dow and the Sensex. But the resistance by the 200 day EMA and the volume drop off may be the first signs of the global bear market rally coming to an end soon.

No comments:

Post a Comment